Wint Wealth is an Indian fintech platform that facilitates investments in senior secured non-convertible debentures (NCDs), offering an alternative to traditional fixed deposits (FDs).

In this article, we will provide you with a detailed review of Wint Wealth. We will also answer is Wint Wealth safe, compare Wint Wealth other options and share some WintWealth alternative.

Wint Wealth Review

Today, there are many platforms that allow you to buy bonds and make investments in different avenues. It is important to understand all the pros and cons of these platforms and how much risk is involved in using them. We have done a detailed breakdown of Wint Wealth, so you can have utmost clarity about it. Let us get started with understanding what type of platform Wint Wealth is.

What is Wint Wealth?

It is a platform for NBFCs (Non-Banking Financial Companies) to raise financing. It gives its consumers a list of assets and a solid set of returns on their investment. Wint Wealth provides senior secured bonds from various firms directly to the consumer.

Wint Wealth has created covered bonds for retail investors, which offer increased security. In this Wint Wealth review, let us go over some of the features provided by Wint Wealth.

-

Higher Returns: Offers interest rates typically ranging from 9% to 12% per annum, which is higher than traditional FDs.

-

Senior Secured NCDs: Focuses on bonds backed by collateral, providing an added layer of security to investors.

-

Low Minimum Investment: Allows investments starting from as low as ₹10,000, making it accessible to a broader range of investors.

-

Short to Medium Tenures: Investment durations typically range from 1 to 3 years, offering flexibility.

-

SEBI-Regulated Platform: Operates under the regulation of the Securities and Exchange Board of India (SEBI), ensuring compliance and oversight.

Let us understand what a senior secured bond means.

Basically, the bond is like a fixed asset. Financial securities such as bonds are owed money by their issuers to their buyers. It is the issuer’s responsibility to repay the principal amount and interest over time. A bond is of two types:

- Unsecured bonds are the ones where no security is included in the deal. If the firm ceases operations, you have very little prospect of collecting your primary funds from the company.

- A secured bond is one that has adequate security backing. As a result, if the firm fails, you have a better chance of receiving your capital back.

Finally, senior secured bonds imply that in the case of the company’s liquidation, the senior-most secured bondholders will recover their investments first. The Senior Secured Bond issued by Wint Wealth is solely based on this strategy.

Features of Wint Wealth

There are many features that make Wint Wealth the best platform for investors. As promised we will go through each feature of Wint Wealth in this Wint Wealth review.

1. Returns are higher than Fixed Deposits

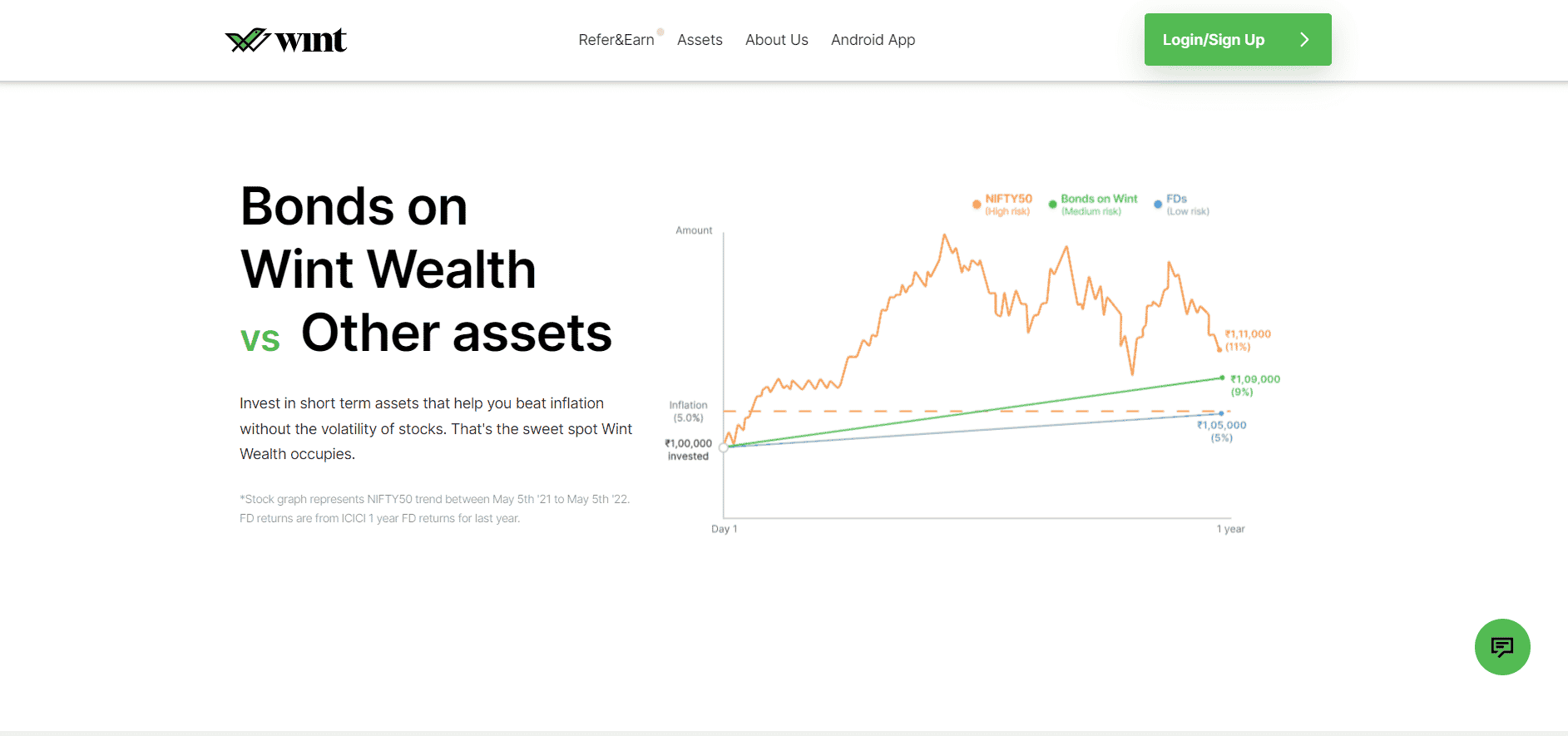

The constant decline in the returns on fixed deposits has led to the rise of Wint Wealth. A Senior Secured Bond is comparable to an FD since it is a safe and secure fixed-income asset. They do, however, provide substantially higher returns than FDs, averaging 9% to 11%.

2. Investments are secure on the Platform

Due to the numerous financial industry frauds, buyers are often afraid to make direct investments. To combat this, Wint screens out the top businesses and only offers investors the most secure choice.

3. Minimum Risk

Senior secured bonds from Wint Wealth carry a fraction of the risk that the stock markets do. Wint’s investment products may be your best option if you have a low-risk tolerance or want to avoid losing your primary investment.

4. Small Ticket Size

In contrast to conventional bond investments, Wint allows ordinary investors to engage in these fixed-income products for as little as Rs. 10,000. As a result, you don’t have to spend a large quantity on these assets and may begin with a small investment to earn significant returns.

Benefits of Wint Wealth

Let us continue our Wint Wealth review by analyzing some of its benefits:

-

Enhanced Returns: Provides higher interest rates compared to traditional FDs, potentially leading to better wealth accumulation over time.

-

Diversification: Offers an opportunity to diversify investment portfolios beyond equities and traditional debt instruments.

-

User-Friendly Platform: Features a seamless online interface for account setup, KYC verification, and investment management.

-

Transparency: Provides detailed information on each investment opportunity, including associated risks and company profiles.

Is Wint Wealth safe?

If you are investing in any platform, you need to know what is the risk that might be involved with that platform. We can’t complete this Wint Wealth review without answering this important question. Some of the risks involved with Wint Wealth are as follows:

-

Credit Risk: Despite being senior secured, NCDs carry the risk of issuer default. It’s essential to assess the creditworthiness of issuing companies.

-

Tax Implications: Interest earned is taxable as per the investor’s income slab, which may reduce net returns, especially for those in higher tax brackets.

-

Liquidity Constraints: While Wint Wealth offers a ‘sell’ feature, the secondary market for these bonds may have limited liquidity, potentially affecting the ease of early exit.

-

Reinvestment Risk: Some bonds may return principal in installments, requiring proactive reinvestment to maintain overall returns.

Risk of Losing Credit

Investors frequently worry that, in the event the startup fails, their money will be lost. These investors have frequently suffered significant losses as a result of the unsecured bonds. By allowing only businesses with surplus security pools to cover their raised money on their platforms, Wint Wealth eliminates this danger. You may even choose to amortize bonds, which would allow you to conveniently get your principal back in payments over a certain period.

Now you know, is Wint Wealth safe? There is enough proof to conclude that the platform is reliable and operates in investors’ best interests. It has the support of dedicated individuals. The website goes to great lengths to inform investors about the deals it offers for investment.

When evaluating the bargains on Wint Wealth, it is essential to compare them to other products that provide comparable returns. All upcoming transactions on Wint Wealth will be public issues, which means that SEBI regulations apply and the platform must adhere to the necessary procedures.

The covered bond feature gives the assets an additional degree of security above comparable NCDs on the secondary market!

Wint Wealth Fees

It is absolutely free to open your account with Wint Wealth. You need to have an account with a SEBI registered broker to get your account. In the case of assets with a fixed interest rate return of 12-14%, they will reduce your interest rate by about 2%.

Also Read: How to Use CRED Coins to Cash?

Wint Wealth vs Golden Pi: A Comparison

The company Zerodha has only released one trading platform called Golden Pi, allowing traders to start trading fixed-income investments.

With Zerodha Golden Pi, traders can choose between bonds from major bond institutions, corporations in the capital market, and bank capital market divisions. Here are some differences between Golden Pi and Wint Wealth.

- The bonds available in Wint Wealth are more diversified to reduce risk factors unlike in the case of Golden Pi.

- There is a fixed income in the case of Wint Wealth, with very low risk and highly regulated bonds. Golden Pi offers returns of up to 13.5% on more risky bonds.

- You get to choose bonds as per your risk appetite with Golden Pi. There are three levels of bonds, which range from high-security with low returns to high returns with low security. In the case of Wint Wealth, security and reducing risks in bond investments are what the customers seek. Therefore, the returns remain 9-11% with a highly secure investment experience.

Given below is a table comparing Wint Wealth and Golden Pi so you can decide if Golden Pi can work as a Wint Wealth alternative or not.

| Features | Wint Wealth | Golden Pi |

| Investment Capital | From 10k or above | From 10k or above |

| Return rates | 9-11% (fixed) | 8-13.5% (variable) |

| Assets involved | Bonds, ETFs, FDs | Bonds, ETFs, PPFs, FDs |

| Tax Exemption | Possible | Possible |

| Team Security | Compulsory | Not compulsory |

Wint Wealth Alternatives

After comparing Wint Wealth with GoldenPi, let’s explore a few more compelling alternatives you might consider alongside Wint Wealth.

1. Grip Invest offers access to lease-based investments with an impressive IRR of 13–15%, ideal for those seeking fixed-income opportunities with higher returns.

2. TradeCred is another solid option, functioning as a marketplace for invoice discounting—allowing investors to earn from short-term, credit-worthy trade receivables.

3. Klubworks focuses on revenue-based financing, making it suitable for those who prefer returns tied to a company’s income stream rather than fixed interest.

4. Lendbox and Cashkumar have also carved a niche with low-risk, fixed-return products that aim to deliver predictable income for conservative investors.

These platforms expand your options beyond traditional bonds and help diversify your fixed-income portfolio with varying levels of risk and reward.

| Platform name | Description | Average return | Minimum return (INR) |

| Grip invest | Make investments in tangible assets such as e-bikes and equipment rented out to startups. | 13-15% | 20000 |

| Klubwork | Financing popular and well-funded Indian companies based on revenue | 17-20% | 250000 |

| Lendbox | Invoice financing and settlement financing opportunities Discounting and P2P loans | 10-14% | 10000 |

| Tradecred | Invest in invoice of blue chips | 10-12% | 50000 |

Wint Wealth stands out as a powerful platform for everyday investors looking to break free from low-yielding fixed deposits and earn higher-return fixed-income products. By offering secured, curated investment options, it helps bridge the gap between safety and better returns—making portfolio diversification more accessible than ever.

In this review, we’ve taken a deep dive into how Wint Wealth works, addressed safety concerns, compared it with GoldenPi, and even explored credible alternatives like Grip Invest, TradeCred, and more.

As always, remember: higher returns come with risks—so invest wisely and align every decision with your goals and risk appetite.