PayTM, the omnichannel payment platform has carved its name within a very short span of time through an app loaded with various features. Sometimes so many features can confuse you, here in this article you will learn what is PayTM and how to use PayTM Wallet.

In today’s revolutionized world, everything has become dependent on technology and the digital aspect. Though it can be seen as both boon and bane sometimes, digitization does help us in many ways. Paytm is one such example. It is an app that helps people to pay online. Everything is done via mobile. The world is trying to become cash-free so that all payments can be made online.

What Is Paytm and How to Use Paytm Wallet?

Paytm is short for “Pay Through Mobile.”Vijay Shekhar Sharma founded the company under the name of One97 Communications. In 2015 in September, China’s Alibaba Group gained a 20 % stake and thus became the largest shareholders of the company – One97 Communication.

Paytm is a digital platform that gives people the chance to transfer their money into the wallet with the help of debit cards, online banking, credit cards, or depositing cash through selected banks and partners. Paytm allows people to pay for the goods via the online method and not by cash.

Paytm’s mobile interface is available in 10 Indian languages – Gujarati, Tamil, Hindi, Telugu, Tamil, Bengali, Marathi, Punjabi, Kannada and Oriya. This is because India is a diverse nation, and launching different interfaces would mean a larger adoption of Paytm all over the country.

Paytm has also announced a new feature that helps individuals to make payments with the help of Paytm Wallet without a smartphone with an internet connection. Though, the person still needs to have a smartphone to create their Paytm account and then link it to their phone number and definitely for loading funds into the wallet. The person needs to call 1800 1800 1234 from the registered mobile number, to get their PIN. The payment by the person is made by dialing 1800 1800 1234, and then, they are required to type the recipient’s phone number, then the amount to be paid, and finally, the PIN for verification.

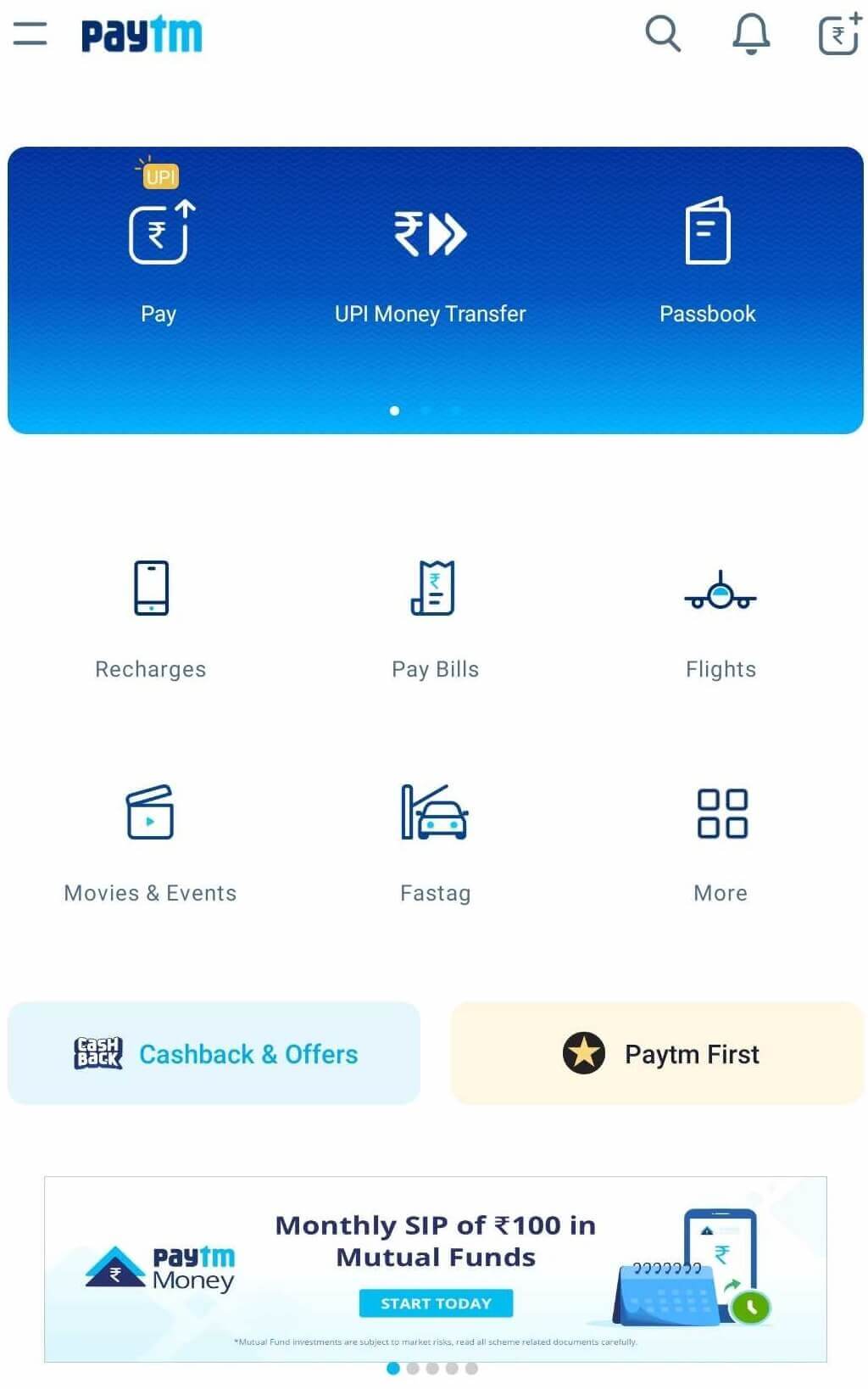

Paytm wallet: What can you do with it?

- The payments for electricity, post-paid mobile phones, gas bills, landline/broadband, and water bills, etc. can be made.

- Fare for Uber car rides can be paid.

- The individuals can buy the goods on Paytm’s e-commerce platform.

- Recharge for data cards, metro cards, DTH cable, prepaid mobile phones, etc.

- Booking tickets for hotel rooms, movies, flights, tickets, buses, trains, etc.

- Offline payments can be made

- People can send money to other people’s Paytm wallet.

How Paytm is used?

If an individual is above 18 years, then he/she is supposed to register their mobile number and Email ID to create the account on the App and then start using it.

- Verification and Registration of accounts are done by filling in the Mobile Number and Email – ID.

- Money is added to the Paytm Wallet from that person’s bank account via net banking, credit card, or debit card.

- Payment is made with the help of Paytm’s money transfer portal.

What is mean by Paytm Wallet?

Paytm wallet is the most important component as this is the tool where money from the person’s bank account or credit card is transferred for the future use of the individual. After opening the Paytm account, one can add cash of up to Rs. 10000 into the wallet. The monthly limit can be increased to 1 lakhs in the Paytm wallet by getting the KYC completed. Know your Customer or KYC Process by which companies and banks do an identification check to help in identifying frauds, theft, and money laundering. For that, Proof of Address and Proof of Identity needs to be submitted.

This can be done physically – where the representative of the Paytm comes to the individual’s house with a KYC form, and the individual then needs to attach the passport size photograph and provide with self – attested copies of proof of address and proof of income.

The paperless method can also be adopted, which involves Aadhar – based eKYC. In this process, the representative of Paytm uses a mobile-based biometric scanner. The approval of the customer is recorded with the help of Aadhar – based eSign.

Safety of Paytm Wallet

When anyone uses digital platforms for money transactions, it is the safety that becomes the foremost concern. Paytm is an RBI approved wallet, which means that the money is safe in the wallet. Paytm uses 128-bit encryption technology. The encryption makes sure that nothing is revealed regarding the password’s length or contents. Thus, everything is safe.

Types of Paytm Account

The types of Paytm account is based on how much money the individual puts into the wallet. These types are:

- Basic Account: This type of Paytm account means that the Customer Paytm Wallet is issued by the details of the customer, which are minima such as Mobile Number, Name, Email Address, which kind of permit payment and use of Indian money for payment.

- Prime Account: This term would mean that the KYC is done of the customer and thus, allowing him/her person – to – person transfer and also he/she can pay to all the identified Merchants as per guidelines by RBI.

How to Open New Paytm Account

For someone to begin, he/she first needs to download the Paytm App on their smartphone. After that, follow the following steps:

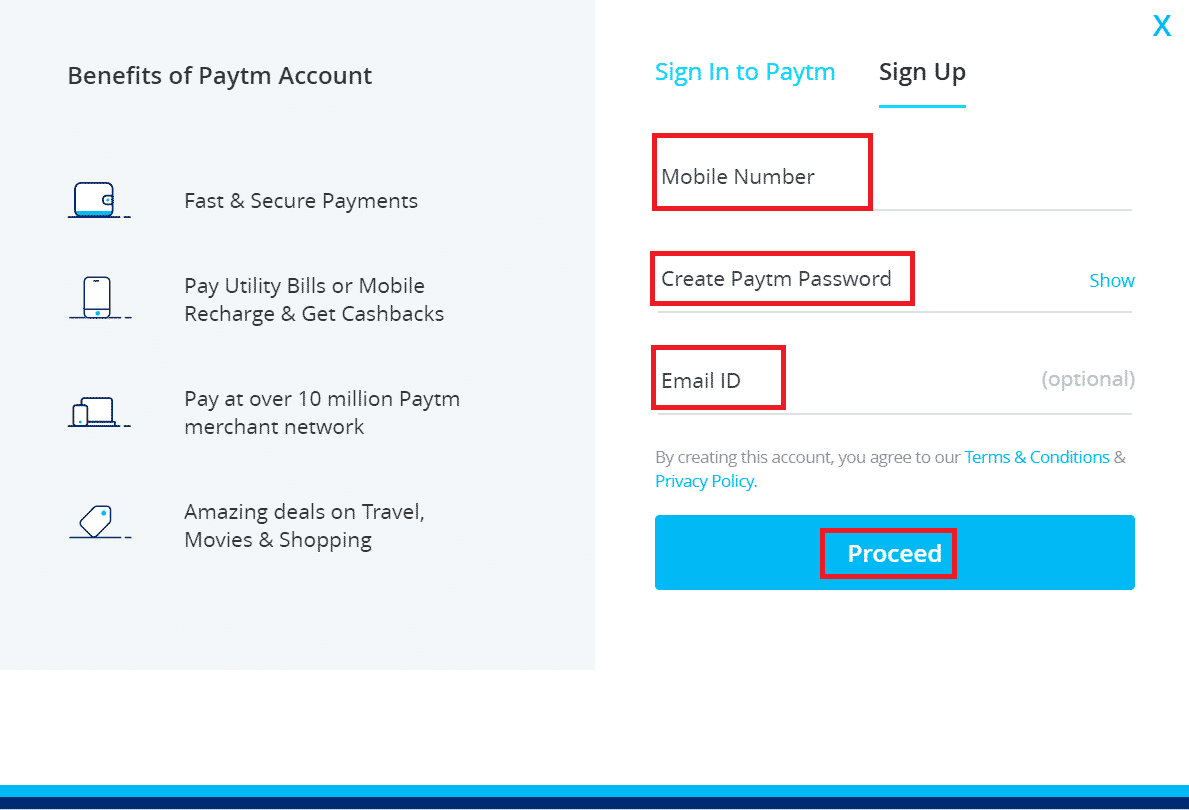

1.Click on Sign up link on the Paytm website or your Paytm app.

2.The boxes for mobile number, email ID, and password would appear. Fill the details and press Continue.

3.A confirmation code or OTP will be sent to the mobile number.

4.Enter the OTP to confirm the given mobile number, one can see the profile page of the Paytm account. One can enter various other personal information to complete the profile.

Follow these steps to add cash to your Paytm wallet?

- First, log in to the Paytm account and then click on the Paytm Wallet icon or the Add Money tab on the homepage.

- The person then needs to fill the amount of money he/she wants in the wallet and then click on Add Money.

- If the person has any promotional code or voucher code, then he/she can apply the promo code. If the person doesn’t have promo code, then leave that space empty and click on Proceed to Pay Rs.

- The individual can choose the ways to add money via IMPS, Net Banking, Debit card, or Credit card.

- Then, the person will be redirected to the secure payment page where the individual needs to fill in the payment details.

- Choose the method by which the amount will be paid.

- If the person has saved a credit card or debit card, then his/her card will show up, and they only need to fill in the CVV number to proceed to the bank page. If there are no saved credit cards or debit cards, then they can save the card for future use.

- Once the transaction is completed, the person will be redirected to the Paytm page with added money in the Paytm wallet.

Also Read: 7 Best UPI Payment Apps in India 2020

How to do Paytm to the bank account transfer?

Anyone can transfer money from their Paytm wallet to their bank account but with the following terms and conditions:

- The account of the user is supposed to be registered for a minimum of 45 days.

- The user should have a minimum balance of Rs. 2000 in the wallet.

- The maximum of Rs. 5000 can be transferred in each transaction.

- A convenience fee of 4 % from the transferred amount would be charged.

Steps of transferring money from Paytm wallet to bank account

- The person needs to open the Paytm app and then tap on the ‘Pay’ or ‘Send.’

- Click on the Send to Bank button.

- The person is required to fill the asked details such as account number, IFSC code, etc.

- The amount is entered and then click on Send.

- The money will immediately be transferred to the specified bank account.

How to recharge your mobile using Paytm?

For recharging, the person needs to follow the following steps:

- The person needs to enter the mobile number.

- The operator of the phone should be then selected.

- The recharge value is entered.

- The person is then supposed to enter the Paytm password.

- Finally, select the mode of payment, such as credit card, debit card, or net banking.

Paytm does surely prove to be quite handy as there are several of the tasks that could be handled through a single click. The booking of movie tickets, the recharge of a phone, and even the transfer of money into banks can be made via Paytm. Thus, it helps to make life easier.