In a world where fintech startups are popping up faster than you can say “digital transformation,” one company is quietly (okay, not so quietly) rewriting the rules of Supply Chain Finance (SCF). Meet Veefin Solutions Limited, the Mumbai-based tech disruptor that’s turning heads, breaking records, and casually racking up ₹80.44 crore in revenue while sipping chai and scaling globally.

Let’s rewind and unpack how this BSE-listed startup went from niche to necessary.

The Origin Story: Not Your Average Startup Garage Tale

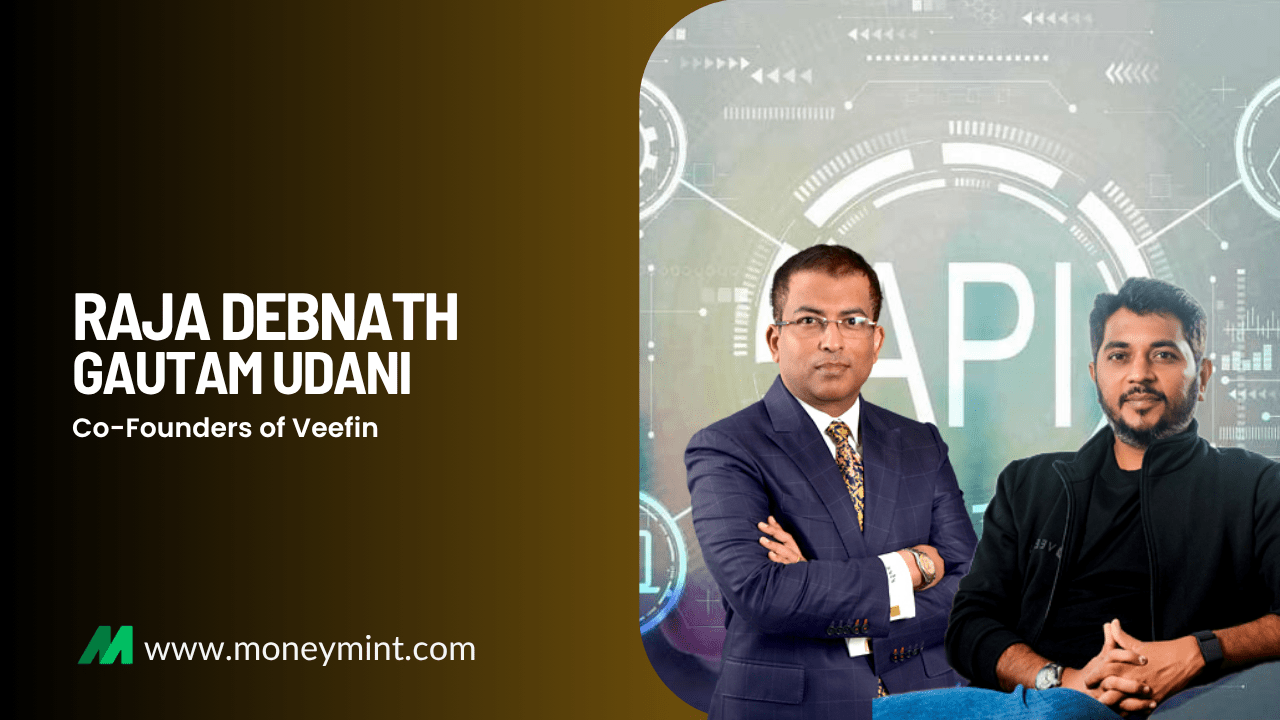

Founded in 2020 by Raja Debnath and Gautam Udani, Veefin wasn’t born out of a dorm room or a caffeine-fueled hackathon. It was built by two seasoned pros who knew the financial world inside out and saw a massive gap in how SCF was being handled.

- Their mission? Make Veefin the 1 Global SCF Platform.

- Their vision? Be the best. Accept no less.

- Their vibe? Tech-first, people-powered, and allergic to mediocrity.

Meet the Brains Behind the Boom

Raja Debnath – The Banker Who Went Builder

With MBAs from Oxford University and JBIMS, and a resume that includes IFC (World Bank), EY, Citibank, Kotak, and more, Raja isn’t just a fintech founder; he’s a walking masterclass in SME banking and SCF. At IFC, he led multi-bank SCF programs across Asia and helped over 25 lenders level up.

At Kotak, he built the Small Business Unsecured Lending vertical from scratch. Now, as Managing Director of Veefin, he’s steering the ship with a mix of global insight and local hustle. Oh, and he’s also a food entrepreneur. Because why not?

Gautam Udani – The Tech Architect with a Midnight Food Startup Past

Gautam, Veefin’s COO and Wholetime Director, is the tech wizard behind the curtain. With a BE from Mumbai University and a Master’s in IT from NJIT, USA, he’s a two-time founder who previously ran Infini Systems, delivering 250+ apps across industries.

He’s also the guy who co-founded India’s first midnight food delivery platform (yes, really). At Veefin, he’s the one making sure the platform isn’t just functional, it’s futuristic.

What Does Veefin Do? (And Why Should You Care?)

In simple terms: Veefin builds digital tools that help banks, NBFCs, fintechs, and corporates manage their lending and supply chain finance like pros.

Their platform covers everything from:

– Customer onboarding

– Underwriting

– Loan management

– Collections

– Analytics

– And even delinquency management (because not everyone pays on time 😬)

It’s like giving financial institutions a cheat code to run smoother, faster, and smarter.

The Numbers Don’t Lie

Veefin’s financials are the kind of glow-up every startup dreams of:

- Revenue: ₹80.44 crore in FY25 (up 222% YoY from ₹24.99 crore)

- PAT: ₹16.26 crore (up 120% YoY)

- Shareholder PAT: ₹13.38 crore (up 81% YoY)

- EBITDA: ₹542.32 lakhs in H1 FY25 (up 257%)

- Global ARR Disbursed: $15 billion+

Translation: They’re not just growing, they’re sprinting.

Global Expansion? Say Less

In just the first half of FY25, Veefin:

– Expanded into Southeast Asia, the Middle East, Africa, and Latin America

– Completed 3 strategic acquisitions

– Went live with 9 new clients across the globe

That’s not just scaling. That’s main-character energy.

Culture Check: HumansOfVeefin Is the Real MVP

Behind the tech and numbers is a team of 200+ people across 3 countries, and they’re not just employees, they’re Veefinites.

Through their HumansOfVeefin campaign, the company shares real stories of resilience, growth, and the occasional office chai debate. From engineers to designers to support staff, it’s a reminder that tech is built by humans, for humans.

And yes, 3 a.m. client calls are a thing. But so is answering them with a smile. (Okay, maybe a sleepy smile.)

Awards, Accolades & All That Jazz

Veefin’s trophy shelf is getting crowded. They’ve been recognized for:

– Most Innovative SCF Solution

– Best Trade Finance Implementation

– Top 100 Emerging Startups Globally

– And more industry shoutouts than your LinkedIn feed on a Monday morning

So, What’s Next?

According to Raja Debnath, the focus is clear: keep innovating, keep expanding, and keep delivering value to clients of all sizes.

With a product suite that’s getting sharper, a team that’s getting stronger, and a market that’s hungry for smarter SCF solutions, Veefin is just getting started.

Final Thoughts: From Underdog to Unicorn-in-the-Making

Veefin isn’t just another fintech startup. It’s a movement that’s democratizing access to SCF, empowering financial institutions, and proving that you don’t need to be a Silicon Valley darling to make global waves.

With a killer combo of tech, talent, and tenacity, Veefin is showing the world how India does fintech, with brains, heart, and a whole lot of hustle.

So next time someone says, “Supply Chain Finance is boring,” just send them this article. And maybe a Veefin demo link. 😉

Follow their journey: Veefin