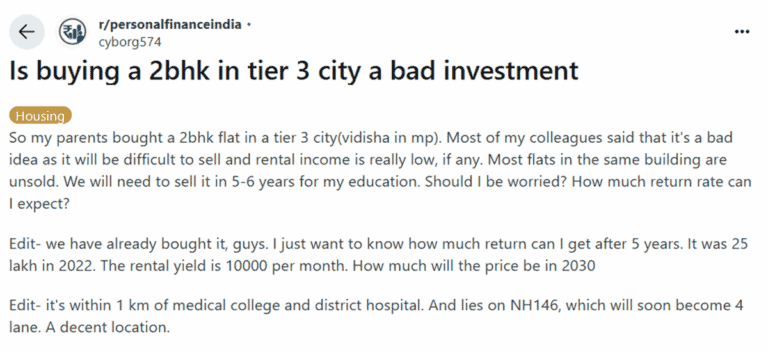

A recent Reddit post has ignited a debate online after a user questioned the wisdom of their parents’ decision to invest in a 2BHK flat in Vidisha, a Tier-3 city. The home, purchased for ₹25 lakh in 2022, is in a prime location near the city’s medical college, district hospital, and the soon-to-be-upgraded NH-146—a spot that would make any auto rickshaw driver proud.

The urgency? The flat’s resale value and liquidity in the next 5–6 years.

“Most flats in the same building are unsold. We will need to sell it in 5-6 years for my education. Should I be worried?” the Reddit user asked.

Rented at ₹10,000 per month, does sprinkles some relief over their investment woes.

Crowd’s Wisdom: Divide and Conquer

The Reddit crowd, never one for silence, didn’t hold back to comment on the post.

One user said: “Flat in a Tier-3 city is a very bad idea. Forget appreciation, you may not recover invested capital too.”

Ouch!

Others came brandishing property wisdom from Small Town 101: “Invest in a land, then. Way better returns than a residential flat.”

The logic? Land remains king where flat culture hasn’t taken root—much like tea in a city of coffee drinkers.

Yet, in this digital courtroom, hope found a few defenders. One optimist calculated that steady rental income signals demand.

“Rental income is good. That means there is demand for your flat,” they posted, adding a dash of sunshine to the gloomy forecast.

A few even suggested that, with luck and a four-lane highway, the property might touch ₹40 lakh or more by 2030—proof that real estate dreams age better than the rest of us.

On the Road to 2030: Should You Be Worried?

As the NH-146 prepares for its four-lane facelift and the debate rages on, only time will tell whether this Vidisha flat proves to be a jackpot or a “learning experience.” For now, if you’re holding property in a Tier-3 city, here’s a tip: hang on tight, watch the infrastructure news, and never underestimate the power of rental income or the wisdom of anonymous internet sages.