From Grocery Store Struggles to MSME Heroes

It’s 2017, Bengaluru. Three IIT Kanpur graduates, Harsh Pokharna, Gaurav Kumar, and Aditya Prasad, were fed up with watching local grocery store owners drown in chaotic piles of loose paper slips for tracking credit payments. Paper ledgers? Fragile. Tallying accounts? A nightmare. And misplaced receipts? Every shopkeeper’s worst enemy. After noticing this mess during their frequent trips to neighbourhood stores, the trio had a eureka moment: Why not digitise the bahi khata (ledger book)?

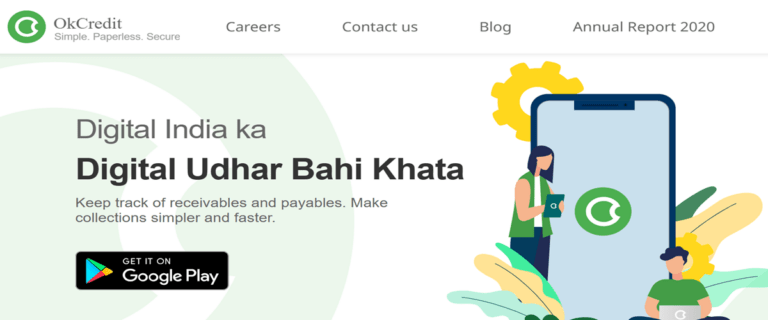

Enter OkCredit, a mobile-based solution for MSMEs to record credit and payment transactions digitally. What began as an idea born out of frustration with disorganized accounting has grown into one of India’s favourite bookkeeping apps, impacting millions. How did they turn this simple idea into a series-B-funded business with backing from Y Combinator, Lightspeed India, and Tiger Global? Let’s break it down. 🔍✨

When Failure Fuels Your Success

But let’s rewind a little. The OkCredit journey wasn’t all smooth sailing. Before the app became synonymous with digital bookkeeping, Harsh, Gaurav, and Aditya failed spectacularly. Between 2016 and early 2017, they burned through their savings working on three different ideas, all of which flopped. Things got so bad that they had to pick up freelance gigs just to survive. In Harsh’s own words, they were “two years deep into failure, exhausted, and nearly hopeless.”

Then came the tempting offer: a fat paycheck for a full-time job in Silicon Valley. An easy way out, right? Wrong. Harsh’s cofounders weren’t ready to throw in the towel, they had faith in their ability to build something impactful. Buoyed by their confidence, Harsh turned down the offer, and the trio decided to give it one last shot.

Looking back now, Harsh says, “It’s amazing how far you’ll go when someone believes in you.”

How a Simple Idea Took Root

The spark for OkCredit came from their personal experiences. Whenever the founders bought groceries on credit, settling the bill was a disaster. Shopkeepers relied on loose paper scraps to track transactions, which often led to errors, confusion, and a bill higher than expected. This wasn’t just inconvenience, it eroded trust between customers and merchants.

To tackle these problems, the founders convinced a local shopkeeper to test OkCredit. Sure, he was sceptical at first (digital anything seemed sketchy back then), but the founders persisted. They even spent days generating daily reports to crossverify the app against his physical ledger. Within weeks, the shopkeeper added more customers to the system, and the magic of OkCredit started to spread.

The rest, as they say, is history. 🚀📈

What Makes OkCredit Shine?

OkCredit isn’t just another app, it’s a revolution in how MSMEs handle money. Here’s why merchants love it:

- Digital Ledger Book: Say goodbye to paper receipts! With OkCredit, merchants can replace their old bahi khata and never miss a single entry.

- Ease of Use: Managing credit and debit records is ridiculously simple, no tech wizardry is required.

- Trust and Transparency: Merchants can share real-time account statements with customers, eliminating disputes.

- Secure and MadeinIndia 🇮🇳: Built with trust and tailored to Indian businesses.

It’s intuitive, it’s impactful, and it’s putting MSMEs on the digital map.

Challenges Along the Way: Building Resilience

OkCredit’s journey hasn’t been all sunshine and rainbows. From tough market conditions to internal growing pains, here are some hurdles the company faced—and conquered:

- The Layoffs: 18 months ago, the company let go of 70 employees as it struggled to control its burn rate after expanding too fast. What set OkCredit apart, however, was how it handled layoffs. Founders personally spoke to each employee, offered three months’ notice, and helped with referrals and job leads. Out of the 70 laid off, 67 found new positions before their notice period ended. Now, that’s accountability. 🙌

- EBITDA Struggles: In 2022, their EBITDA was at a painful 614%. The media wrote them off, and sceptics doubted their survival, but OkCredit didn’t give up. They focused on capital efficiency, made tough calls, and stayed patient. This month (Feb 2025), they’ve hit 22% EBITDA and are on track to turn profitable by May 2025. 💪

- Overcoming Stigma: Convincing merchants to adopt digital solutions was hard in a country where trust in online systems wasn’t exactly thriving. By patiently addressing concerns and building credibility, they earned the trust of MSMEs. 🌟

From Startup to Series B Success

With millions of active users and support from big investors like Tiger Global, OkCredit isn’t just surviving, it’s thriving. Here’s a snapshot of their funding journey:

- Raised $84.9M: Across multiple rounds, including backing from Lightspeed India, Y Combinator, and others.

- Current Valuation: An impressive $1.48 billion.

- 16 Competitors: Including big names like Khatabook, but OkCredit continues to hold its ground. 🏆

Their journey proves that innovation and resilience can disrupt even the most traditional industries.

Big News: Turning Profitable Soon

After years of hard work, OkCredit is finally seeing light at the end of the tunnel. Harsh recently shared on LinkedIn,

“Startups don’t die because they run out of money; they die when people stop believing. We didn’t. And now, we have a clear path to profitability by May 2025.”

The app has fundamentally changed the way India’s MSMEs operate. With its emphasis on digital transformation, cash flow improvement, and financial inclusion, OkCredit is empowering merchants in ways that were unimaginable a decade ago. Whether it’s enabling faster receivables or promoting better accounting practices, OkCredit is here to stay.

What’s Next for OkCredit?

The future looks bright for this Bengaluru-based company. From achieving profitability to expanding their reach, OkCredit has ambitious plans:

- Scaling Up: Targeting even more MSMEs across India.

- Innovative Features: Enhancing the app’s capabilities to serve evolving merchant needs. 📱

- Strengthening Trust: Continuously working to build deeper connections with merchants.

OkCredit’s journey isn’t just about building a product, it’s about solving real-world problems for India’s business owners.

Final Thoughts: Small Slips of Paper, Big Dreams

From humble beginnings to big milestones, OkCredit’s journey is a testament to grit, resilience, and the power of believing in a simple idea. Harsh, Gaurav, and Aditya turned everyday struggles into opportunities, proving that innovation can disrupt even the oldest industries.

And honestly? We’re rooting for them. Here’s to OkCredit, helping MSMEs digitize, grow, and thrive one transaction at a time. 🚀✨