From Digital Wallets to Wallet-Bursting Dreams 🤑

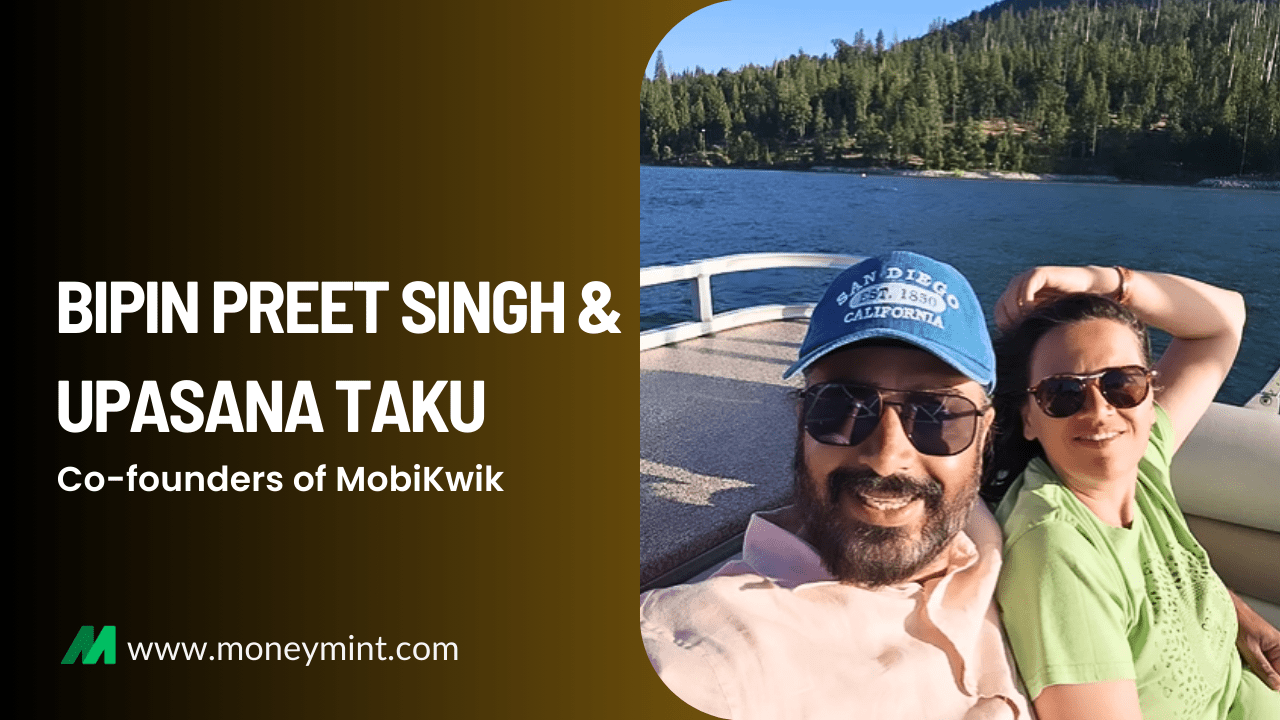

Founded by Bipin Preet Singh and Upasana Taku in 2009, MobiKwik started as a solution to a simple problem: making digital payments easier. What they didn’t know was that they’d spark a revolution in financial inclusion across India. From wallet-based transactions to QR codes that you can spot at practically every kirana store in the country, MobiKwik has been the dependable underdog.

A Brief History: Wallets, Waves, Wins

It started as a digital wallet back in 2009, thanks to Bipin Preet Singh and Upasana Taku, two names you’ll wanna remember. What began with a mission to make recharging your phone less painful grew into a fintech powerhouse that’s now part of India’s digital economy backbone.

Some fun stats:

📌 172 million users strong.

📌 Merchant network spread across a whopping 4.5 million.

📌 Active in 99% of India’s pincodes. That’s right, even Grandma’s village has MobiKwik stickers.

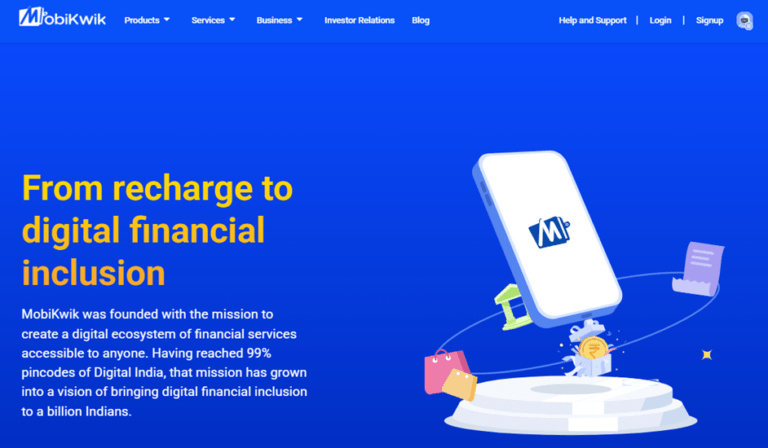

The Bigger Vision: Financial Independence for Bharat

MobiKwik isn’t just about payments and recharges anymore. Over the years, they’ve introduced wealth management products to help users dive into India’s growth story. They’re all about making financial services available to EVERYONE. Think of them as that one friend who tries to include everyone in the group chat.

Their secret sauce? Big data and deep data science. They use lots of ones and zeros to figure out what customers want, need, and swipe for.

MobiKwik’s Next Big Move: Stocks and Chill

MobiKwik, the OG player in India’s fintech scene, is on a roll. After winning hearts with their digital wallet (and snazzy QR codes), they’re now aiming for the stars, well, stock market stars. The company just announced its leap into securities broking with a fresh subsidiary, MobiKwik Securities Broking Private Limited (MSBPL).

All set to turn the broking game upside down (or at least try to), MobiKwik promises to make trading stocks, commodities, currencies, and derivatives as smooth as sliding into a DM.

Talk about levelling up! Their aspirations include getting memberships in stock and commodity exchanges across India and beyond.

Yup, MobiKwik is ready to make some international noise too. 🌎

The Visionary Forces Behind Mobiwik

Upasana Taku’s journey from a corporate high-flyer to a fintech trailblazer wasn’t exactly a straight road, it was more of a thrilling rollercoaster 🎢 (with some loop-de-loops of uncertainty). After finishing school in Surat, Upasana went to the NIT Jalandhar, for her B.Tech, but she wasn’t done flexing yet.

Stanford University came next, where she earned her MS in Management Science & Engineering 🎓. Then came the big leagues: HSBC in San Diego, where she dabbled in everything from market research to outreach, followed by a gig at PayPal, where she mastered the art of payment systems, risk detection, and user experience across continents.

Despite the comfy corporate life (read: paychecks and stability), Upasana found herself itching for something more meaningful.

By 2008, she realized that making millions for giant corporations wasn’t cutting it.

So, in early 2009, she packed her bags and flew back to India, diving into the startup ecosystem and hunting for the next big thing.

The Catch? The Realization

India was still living in a cash-first economy. Digital wallets were a foreign concept. That’s when a mutual friend, introduced her to Bipin Preet Singh, an engineer with a startup dream of his own. He had already taken the plunge in August 2009, and Upasana, still testing the waters, started helping out. Six months in, she was all in, and MobiKwik officially had its co-founder.

Hitting the Market

MobiKwik started simple, a platform for mobile recharges. But back then, people still ran down to the nearest shop for a ₹10 top-up. Upasana and Bipin flipped the script, making it ridiculously easy to recharge from anywhere. Fast forward a few years, and the little recharge platform had evolved into India’s first mobile wallet.

By 2010, they hired their first employee. By 2011, they had a six-member team working out of Upasana’s apartment, where lunch breaks meant home-cooked meals and late-night coding marathons were fueled by Maggi.

In late 2011, they finally rented their first office in Dwarka. A year later, they had a 25-member team and moved into a second office. The real breakthrough came in 2013 when they secured their RBI PPI license, essentially their golden ticket in the fintech world. Until then, they had been bootstrapping, running lean with a growing team.

Funding Reality: Starting Small

Let’s spill the tea on finances. MobiKwikhas kicked off MSBPL with an initial investment of ₹1 lakh. Okay, not the kind of number that screams baller, but hey, Rome wasn’t built in a day. They plan to invest ₹2 crore in tranches, basically, “pay in parts, flex later” mode.

Trading Territory: Beware, Titans ⚔️

By stepping into the stock broking world, MobiKwik is diving into waters dominated by whales like Zerodha, Groww, and Angel One. These giants have already mastered the game. MobiKwik? They’re the new kid on the block with big ambitions.

But hey, Gen Z will tell you, “You don’t need to compete if you’re built differently.”

Now whether MobiKwik is actually built differently is the million-dollar (or maybe multi-crore) question. But one thing’s for sure, they’re banking on their massive 172 million user base and their 5 million merchant network to flex their muscles. 💪

Timing is Key: Why Now?

The timing of this expansion feels anything but random. Just last month, MobiKwik casually bought a 3.39% stake in Blostem Fintech, a platform that aggregates fixed deposits. With Blostem’s expertise in banking infrastructure and MobiKwik’s growing ecosystem, this feels like the fintech equivalent of assembling the Avengers.

The Numbers Game: Profits? Not Yet

Okay, before you start simping on MobiKwik, here’s the reality check. In Q3 FY25, they clocked in ₹269 crore in revenue.

Not bad, right?

But then comes the net loss ₹55.2 crore. Ouch.

Current market cap? ₹2,393 crore. Share price? ₹308. So yeah, they’re not exactly printing money right now, but that’s fintech for you, sometimes, it’s more about vibes than balance sheets.

What’s Next?

MobiKwik’s mission is more than just earning profits it’s about democratizing access to financial services. Think of them as the Robin Hood of fintech, bringing investments and wealth management options to every corner of India.

Their recent venture into securities broking via MSBPL shows their commitment to empowering individual investors. They want trading stocks, commodities, and currencies to be less intimidating for everyday folks.

“Don’t fear the market, embrace it” seems to be their vibe.

And hey, let’s not forget how they’re utilizing big data analytics and deep data science to deliver cutting-edge financial products. That’s some tech wizardry we’ve got to applaud! 🧙♂️

The launch of MSBPL is just the beginning. If everything goes according to plan, we’ll soon see MobiKwik broking ads featuring catchy taglines, quirky influencers, and maybe even Bollywood collaborations.

Picture this: Alia Bhatt said, “Investing has never been this easy!”

All jokes aside, if MobiKwik can manage to carve out its niche in the broking world while keeping costs low and user experiences high, we might be looking at the underdog story of the year.

Will MobiKwik manage to shake things up and become the next big broking platform? Or will they just be another app cluttering our phones? Only time and trades will tell. But one thing’s for sure: they’re here to make some serious noise. 🎷