Because Medical Bills Shouldn’t Come with Financial Panic

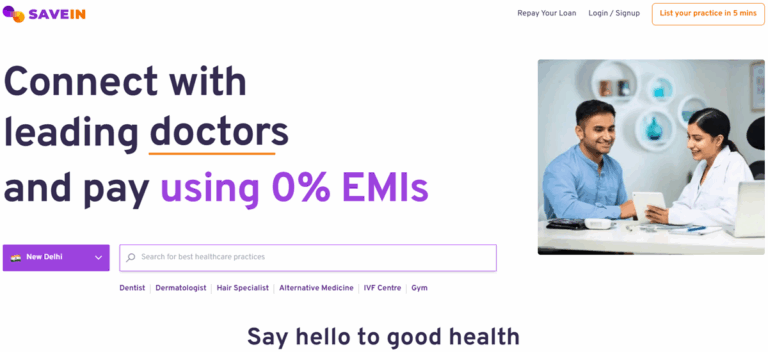

Picture this: You walk into a dentist’s clinic, get the treatment you need, and at checkout, you see an option to split your bill into zero-cost EMIs instantly, without paperwork, claims, or approval delays. Sounds futuristic? Nope! That’s just SaveIN, India’s first embedded healthcare commerce and fintech platform.

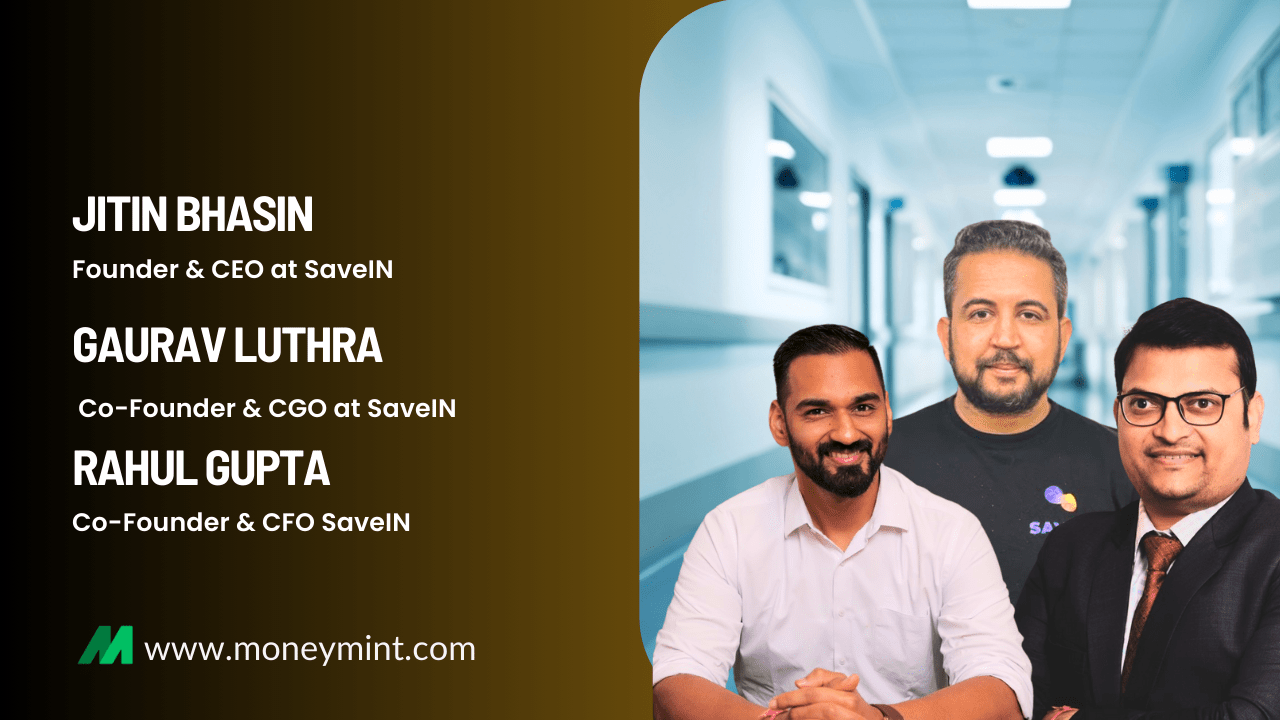

Founded in 2022 by Jitin Bhasin, Gaurav Luthra, Anurag Varma, and Rahul Gupta, SaveIN isn’t just another lending platform, it’s a healthcare marketplace connecting customers with 7,000+ partner clinics across 130+ cities. Whether you need dental work, fertility treatments, dermatology services, Ayurveda therapies, or hearing aids, SaveIN ensures you get quality care without financial stress. And with their latest funding round of ₹37 Cr ($4.3M) led by 10x Founders, they’re on a mission to scale even further. 🚀

The Problem: Healthcare Costs Can Be Brutal

Healthcare in India isn’t cheap. A single dental implant? ₹30,000+. Fertility treatments? ₹1.5 lakh+. Laser eye surgery? ₹50,000+. Many Indians delay essential treatments simply because they can’t afford upfront costs.

This is where SaveIN steps in:

- No-cost EMIs: Get treated now, pay later without interest.

- Instant Approval: No tedious paperwork, no waiting for banks to process loans.

- Wide Coverage: Works across dentistry, dermatology, fitness, Ayurveda, fertility, and more.

In short, healthcare financing needed a glow-up, and SaveIN made it happen.

What Exactly Does SaveIN Do?

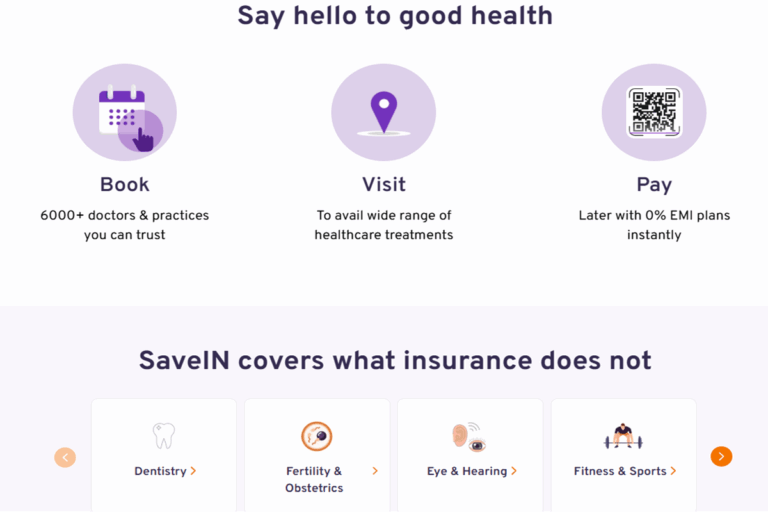

SaveIN is not a bank or NBFC, but it works closely with financial institutions to enable cashless healthcare. Here’s how it operates:

- Healthcare Marketplace: Helps users find trusted clinics and wellness centers near them.

- Instant Credit: Patients can split 100% of their medical bills into affordable EMIs.

- Fintech Integrations: Collaborates with HDFC Bank, ICICI Bank, IDFC First Bank, and others for seamless payments.

- QR-Based Checkout: Their simple scan-and-pay system makes paying medical bills painless.

Think of it as the Pay Later revolution, but for healthcare expenses.

Big Wins & Funding Power Moves

SaveIN has been making serious strides in the healthcare space:

- ₹100 Cr ($12M) raised so far from global investors, including Y Combinator, Oliver Jung, and Leblon Capital.

- 7000+ clinics onboarded across 130+ citiesfrom small towns to metro hubs.

- 5 lakh+ customer applications processed for medical financing.

- 250% YoY revenue growth in FY25, proving the demand for no-cost EMIs.

- Top banking partnerships to ensure smooth financial transactions.

In just three years, SaveIN has positioned itself as the go-to platform for healthcare financing in India.

Challenges? Oh, There Were Plenty

Launching a healthcare fintech startup isn’t easy. The founders tackled some serious hurdles

- Consumer Hesitation: Many people still don’t know that no-cost EMIs exist for medical bills! Educating users was key.

- Convincing Clinics: Healthcare providers needed assurance that SaveIN wouldn’t delay payments or complicate billing.

- Scaling Tech & Operations: Expanding to 130+ cities meant ramping up fintech integrations and customer support.

But thanks to consistent execution, SaveIN broke through, proving that healthcare should be affordable and instant without the red tape.

welUp: The B2B Wellness Revolution

SaveIN didn’t stop at consumer financing. Enter welUp, their newest B2B wellness platform that helps companies offer health benefits to employees, because wellness shouldn’t start after you get sick.

💡 welUp Features:

- On-demand doctor consultations for employees.

- Mental wellness programs, because burnout is real.

- AI-assisted diet planning for healthier lifestyles.

- Diagnostic check-ups so employees can track their health proactively.

- Holistic therapies like Ayurveda and homeopathy.

Imagine startups giving employees access to 200+ healthcare services instead of just insurance that kicks in when disaster strikes. That’s the future SaveIN is building.

What’s Next for SaveIN?

This fintech disruptor is just getting started:

- Scaling EMI offerings for even more healthcare sectors.

- Deepening provider networks to onboard 10,000+ clinics by 2026.

- Expanding welUp to reach startups, SMEs, and large enterprises across India.

- Going global? Don’t be surprised if SaveIN takes its healthcare-first fintech abroad.

Their mission? Make healthcare financing as seamless as online shopping.

Final Thoughts

Healthcare financing has been stuck in the Stone Age for way too long. Loan approvals, claims processes, and hidden charges are unnecessary hurdles that make getting quality healthcare a struggle. SaveIN’s no-cost EMI model changes that.

With its massive provider network, seamless payment integrations, and B2B wellness offerings, SaveIN is making everyday healthcare affordable, accessible, and instant. No red tape. No hidden fees. Just care when you need it, without financial stress.

So next time you’re at the dentist, dermatologist, or fitness center, check if they’ve got SaveIN’s QR code at checkout, you just might leave with a healthier you and an EMI plan that doesn’t hurt your bank balance. 💳💊

Are you ready for the future of healthcare payments? Because SaveIN is already building it. 🚀

Say hello to good health. Book Now: Savein