In a world where one wrong click can cost a company millions, cybersecurity isn’t just a tech problem; it’s a survival strategy. And while most firms are still juggling fragmented vendors and reactive solutions, one Bengaluru-based startup is rewriting the playbook.

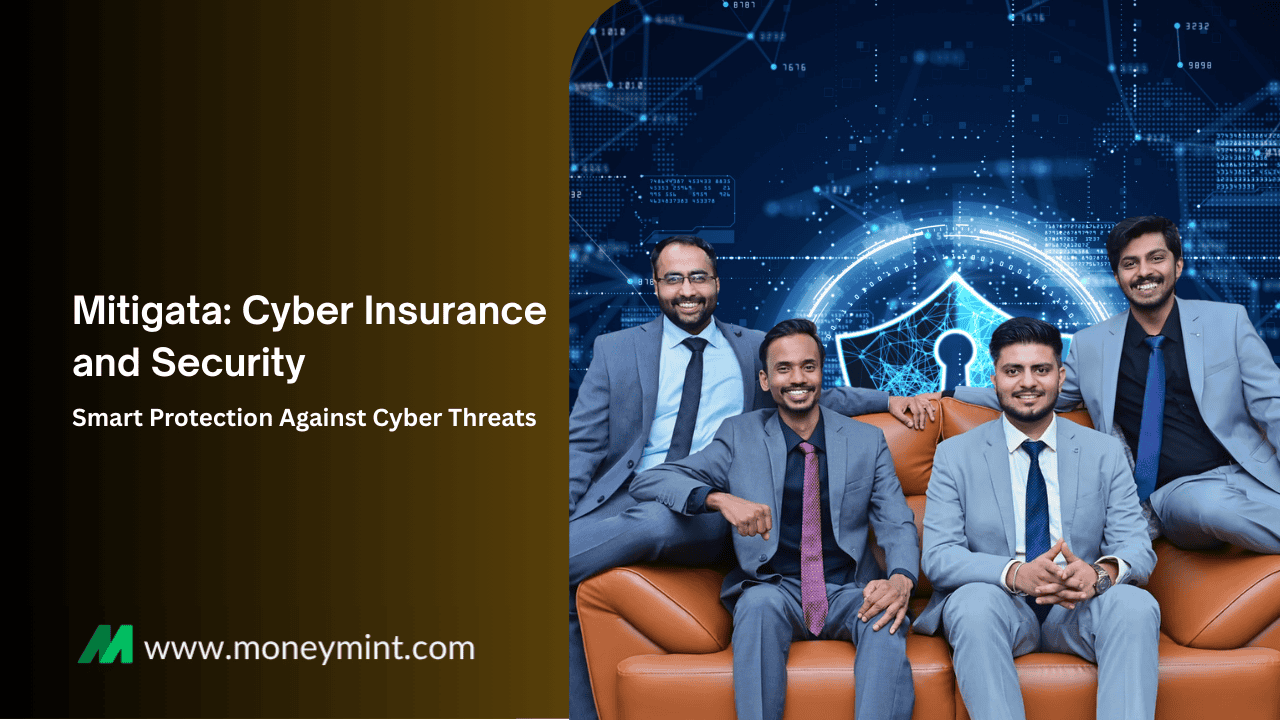

Meet Mitigata, India’s first full-stack cyber resilience platform that’s fusing cybersecurity and insurance into one AI-powered shield. Founded in 2021 by Mohit Anand, Sarthak Dubey, Mayank Morya, and Akshit Kaushik, Mitigata is building the digital equivalent of a superhero suit for businesses and individuals alike.

And with a fresh $5.9 million Series A led by Nexus Venture Partners, they’re just getting started.

The Founders Who Decided Fear Shouldn’t Be a Business Model

Before Mitigata, Mohit Anand and Sarthak Dubey were already deep in the trenches of tech and security. Mohit, an IIT BHU grad, and Sarthak, from Manipal Institute of Technology, saw firsthand how companies were treating cyber insurance and security as two separate cost centers, and paying the price.

So they built Mitigata to fix that. Their goal? Turn fear into fortitude and give businesses the tools to fight back with confidence.

Fun fact: Mohit and Sarthak made it to Forbes 30 Under 30 in 2025, proving that cyber resilience can be both impactful and headline-worthy.

What Mitigata Aoes (And Why It’s a Big Deal)

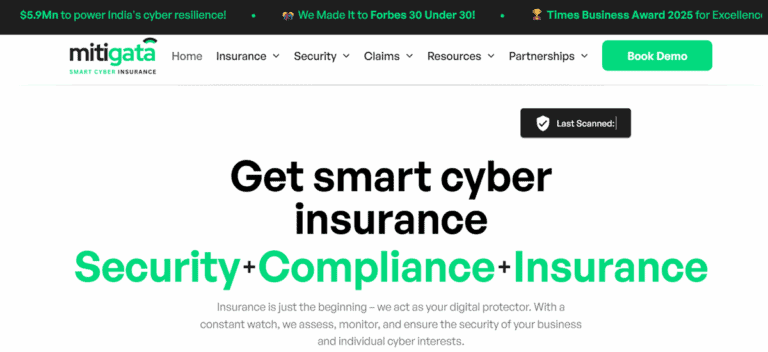

Mitigata isn’t just another cybersecurity firm. It’s a full-stack cyber resilience platform that combines:

- Cybersecurity tools

- Compliance automation

- Risk management

- Cyber insurance brokerage

This means businesses don’t have to juggle five vendors and hope for the best. Mitigata gives them one dashboard, one strategy, and one integrated solution.

And yes, they’re IRDAI-registered, making them India’s first official cyber insurance broker.

The Tech That’s Smarter Than Your Antivirus

Mitigata’s platform includes:

- SOC monitoring (Security Operations Center)

- VAPT (Vulnerability Assessment & Penetration Testing)

- CERT-In empanelled audits

- Incident response and digital forensics

- Attack surface monitoring and threat intelligence

- Phishing simulations and dark web surveillance

They even have RELIQ, a proprietary cyber risk quantification engine, and an AI underwriting tool that structures and prices insurance based on real-time threat data.

It’s like having a cyber command center in your pocket.

Why Businesses Are Loving It?

Mitigata has firmly established itself as a trusted force in India’s cyber resilience landscape, currently serving over 500 enterprises across a diverse spectrum of 25 sectors, including fintech, healthcare, logistics, and retail.

What sets Mitigata apart is its unified approach to cybersecurity and insurance, eliminating the need for fragmented vendors and offering clients a seamless, all-in-one platform. Its intelligent threat detection enables real-time visibility into cyber risks, allowing for swift incident response and smarter, data-driven insurance coverage.

Clients also benefit from streamlined claims processes with better outcomes, reinforcing confidence in the platform’s reliability. Further amplifying its expansion strategy, Mitigata is gearing up to launch three cutting-edge Security Operations Centres in Bengaluru, Mumbai, and Delhi, signaling rapid scalability and a commitment to delivering localized, robust protection across India’s major digital hubs.

Cyber Insurance for Individuals? Yup, That Too.

Mitigata isn’t just for big corporations. They also offer Mitigata Protect+, a personal cyber insurance plan that covers:

- Identity theft

- Phishing attacks

- SMS OTP scams

- Credit card fraud

- Net banking scams

It’s like life insurance for your digital self. Because let’s be honest, your online identity is worth protecting.

The Funding That’s Fueling the Fire

In a strategic move to fortify its mission of transforming cyber resilience, Mitigata successfully secured $5.9 million in a Series A funding round led by Nexus Venture Partners, with additional support from Titan Capital and WEH Ventures. This crucial investment will be channeled into enhancing the capabilities of Mitigata’s AI-driven platform, enriching its suite of cybersecurity and insurance services, and recruiting top-tier talent to drive innovation.

The startup is set to scale its operations across India, with ambitions to expand into global markets, reaffirming its commitment to defending digital ecosystems against rapidly evolving cyber threats.

Recognizing that cybersecurity challenges transcend geographic boundaries, Mitigata aims to offer cross-border resilience, ensuring individuals and businesses are better equipped to navigate the complex threat landscape of the digital age.

Why Mitigata’s Model Is Low-Key Brilliant?

Most companies treat cybersecurity and insurance as separate silos. Mitigata merges them into one cost-efficient, AI-driven solution.

This means:

- Better alignment between risk and coverage

- Faster response times

- Lower operational costs

- Higher resilience across the board

It’s not just smart, it’s necessary.

Final Thoughts: Mitigata Is the Glow-Up Cyber India Needed

In a digital world full of threats, Mitigata is giving businesses and individuals the tools to fight back, with intelligence, speed, and style.

They’re not just selling protection. They’re building India’s cyber resilience infrastructure, and doing it with flair.

So next time you hear about a data breach, remember: Mitigata’s out here making sure it’s not yours.