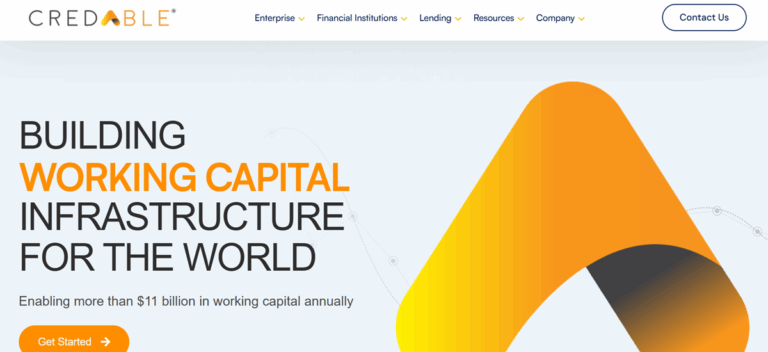

In India’s bustling fintech galaxy, one startup quietly picked the most overlooked problem, working capital, and made it, its star player. Say hello to CredAble, the Mumbai-based platform that helps businesses get the credit they need exactly when they need it.

For small and mid-sized businesses (SMEs), accessing credit often feels like applying for Hogwarts. CredAble’s genius? Making that process fast, seamless, and refreshingly un-magical.

Building a Bridge Where Banks Fell Short

The story began in 2017 when Nirav Choksi and Ram Kewalramani, both seasoned professionals, spotted a credit gap big enough to drive a truck through. While banks played hard to get, small businesses were stuck juggling cash flows and chasing invoices.

So they built a solution. One that connects corporates, financial institutions, and SMEs into a single ecosystem where capital flows like it should, with intelligence and intent.

Meet the Founders: Brains, Grit, and Global Hustle

Nirav Choksi, the CEO, had already co-founded a $500M+ commodities business and invested in 25+ startups before diving headfirst into fintech. With degrees in Computer Science and Economics from the University of Michigan, and a career spanning tech, trade finance, and private equity, he brought the perfect blend of street cred and spreadsheets.

Ram Kewalramani, the Managing Director, added his two decades of experience in investment banking, logistics, and operations. Previously the CEO of an employee transportation firm, Ram knew how to navigate real-world operational chaos, which came in handy building a tech platform for financial flow.

Together, the duo brought domain depth and startup hustle to the table. And it paid off, big time.

What CredAble Offers (Besides Serious Scale)

Sure, they’re not as flashy as crypto or BNPL, but CredAble is solving something arguably more critical: liquidity. Here’s how their three-pronged platform operates:

Credit Solutions

- Invoice Discounting

- Purchase Order Financing

- Pre-Invoice Financing

Trade Infrastructure

- B2B marketplace for trade facilitation

- Supply chain finance

- Business-to-business matchmaking

Payment Tools

- Fast and automated payout systems

- Real-time reconciliation

- APIs to remove friction in large transactions

It’s like the Avengers of business cash flow, only better dressed.

The Growth Trajectory: From FY to Fly High

CredAble isn’t just surviving in fintech; they’re sprinting. The numbers tell a compelling story:

- FY22 Revenue: ₹4.92 Cr

- FY23 Revenue: ₹13.94 Cr (2.78x growth)

- FY24 Revenue: ₹469.56 Cr

- FY24 Expenses: ₹487.59 Cr

- FY24 Losses: ₹18.93 Cr (less than FY23 losses, progress!)

Add to that:

– 175+ corporates

– 100+ financial institutions

– Over 3.5 lakh small business borrowers

– More than $19.2 billion in working capital disbursed annually

That’s more than growth, it’s a financial movement.

Culture: Fast, Curious, and Built to Scale

Beyond the dashboards and APIs lies a team obsessed with first principles thinking. CredAble doesn’t just talk digital, they live it.

It’s no wonder they’ve been recognized as one of the Top 10 Startups in Maharashtra to Work For, with a strong focus on collaboration, agility, and actual outcomes (not just Slack emojis).

Awards That Say “We’ve Arrived”

CredAble’s trophy cabinet could use its floor. Just a few standouts:

- Fintech Startup of the Year – Digital Lending

- Asia Fintech Awards – Team of the Year

- Elets BFSI Award – Best Banking Tech for SCF

- IBS Intelligence – Best Bank-Fintech Collaboration

- Bharat Fintech Summit – Fintech Excellence

- Indian Securitisation Awards – Most Innovative Deal

Translation: When it comes to B2B lending, CredAble’s got the receipts.

Why It Works: Tech + Timing = Trust

While others fumble with clunky systems, CredAble built a modular and API-first infrastructure that works across industries, scales effortlessly, and plugs into existing financial ecosystems.

Their approach is simple:

Make it easy for businesses to get capital when they need it, and let the results speak for themselves.

And the results? Consistently strong partnerships, global expansion potential, and a platform that’s ready for what’s next.

Final Thoughts: Credit Never Looked So Cool

CredAble didn’t arrive with buzzwords or unicorn glitter. They built their empire the old-school way: solving real-world problems with tech that works.

By reimagining how money flows through supply chains, payments, and partnerships, they’re redefining working capital, not as a problem, but as a power-up for business.

So the next time someone says working capital is boring, just point them to CredAble, and maybe also this article.