In a world where every second counts, especially when you’re trying to check out before your cart disappears, Cashfree Payments is the fintech friend you didn’t know you needed. From humble beginnings in a small apartment to processing over $80 billion annually, this Bengaluru-based payments platform has become a silent force behind India’s digital economy.

And yes, they’re the reason your refund hit your account before your coffee order was ready.

The Origin Story: From Apartment to API Empire

Back in 2015, when most of us were still figuring out how to split bills on UPI, Cashfree was born with one goal: to make money movement ridiculously easy. No more clunky bank portals, no more Excel uploads, just clean, fast, API-powered payments.

Fast forward to today, and they’re enabling 800,000+ businesses to send and receive money like pros. From startups to unicorns, everyone’s riding the Cashfree wave.

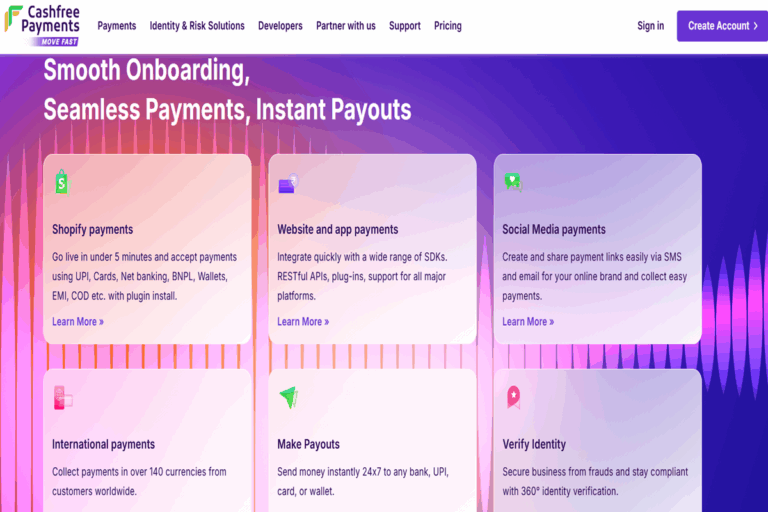

What Makes Cashfree So… Cash-Freeing?

Let’s break it down:

💳 100+ Payment Methods: From UPI to cards to wallets, they’ve got every payment flavor covered. Even your grandma’s favorite net banking option is in there.

⚡ Instant Payouts: Need to send salaries, vendor payments, or refunds? Cashfree’s Payouts API makes it happen in seconds, 24×7, even on Sundays.

🌍 Cross-Border Payments: Going global? Cashfree helps businesses send and receive money across borders without the usual drama.

🛒 One-Click Checkout: Because abandoned carts are a tragedy. Their checkout is so fast, it’s teleportation.

Brains behind Cashfree

Tucked behind the sleek interface of Cashfree Payments is an equally sharp mind, Reeju Datta, one of the co-founders who, along with Akash Sinha, started the company in 2015. The idea sparked when they realized just how painful it was to automate bank transfers for a side project. Rather than accept clunky payment workflows as the norm, the duo decided to solve it themselves.

What started from a tiny apartment quickly evolved into a fintech juggernaut powering over $80 billion in transactions annually. And even as Cashfree faced regulatory speed bumps in FY24, that same spirit of resilience came through, driving innovation like SecureID and earning partnerships with giants across sectors. From building a product that could automate a bank transfer in seconds, to now enabling 12,000 transactions per second, Reeju’s founding story is a reminder that necessity isn’t just the mother of invention, it’s the beginning of something big.

SecureID: Fighting Fraud Like a Fintech Superhero

In 2024, Cashfree dropped a game-changer: SecureID, an identity verification stack that’s already completed 1 billion+ verifications. It’s like having a bouncer for your business, checking PANs, Aadhaar, UPI IDs, and even spotting deepfakes.

And with their new AI-powered Video KYC, onboarding is now faster, safer, and available in 20+ Indian languages. Even your tech-averse uncle from Tier 3 India can get verified without breaking a sweat.

FY24: A Year of Speed Bumps and Speed Records

Despite facing a ban on onboarding new merchants for most of FY24 (thanks, RBI), Cashfree still managed to:

– 💰 Grow revenue by 4.7% to ₹642.7 crore

– 📉 Maintain net loss at ₹135 crore (same as FY23)

– 🚀 Process 1,100+ payments per second

– 🕒 Enable the fastest checkout in just 3 seconds

Talk about thriving under pressure.

Cashfree Reflect: Looking Back, Zooming Ahead

In 2024, Cashfree launched Cashfree Reflect, a year-in-review campaign that celebrated everything from record-breaking transactions to welcoming Rajkummar Rao as their brand ambassador. (Yes, Bollywood meets fintech. We love to see it.)

It wasn’t just a flex, it was a reminder that speed + trust = magic.

Why Businesses Love Cashfree (and You Might Too)?

Whether you’re a solo creator selling handmade candles or a giant e-commerce brand, Cashfree’s got your back:

– Fast onboarding (start transacting in a day)

– Seamless integration with Shopify, Wix, WooCommerce, WhatsApp, you name it

– High success rates thanks to in-house payment processing tech

– Scalability that handles up to 12,000 transactions per second (yes, really)

And if you’re wondering, “Is this just for big brands?”, nope. Cashfree is built for everyone, from side hustlers to enterprise giants.

The Secret Sauce: Agility + Empathy

At its core, Cashfree isn’t just about tech. It’s about understanding what businesses need: speed, reliability, and zero payment drama.

Their motto? “Move Fast.”

And they live it, whether it’s launching new features, resolving issues, or adapting to regulatory changes.

What’s Next: Aiming for ₹1,000 Cr and Beyond

With the RBI ban lifted and new licenses in hand, Cashfree is eyeing a ₹1,000 crore revenue milestone in FY25. They’re also doubling down on non-payment products like:

– RiskShield (fraud detection)

– Flow Wise (payment orchestration)

– BNPL Plus (Buy Now, Pay Later)

– Escrow services for high-trust transactions

Basically, they’re not just a payment gateway anymore, they’re becoming a full-stack fintech ecosystem.

Final Thoughts: Not Just a Payment Gateway, But a Growth Partner

In a fintech world full of buzzwords and broken promises, Cashfree stands out by doing one thing well: making money move fast and smoothly.

So the next time your refund hits instantly, or your checkout feels like a breeze, there’s a good chance Cashfree’s tech is behind the scenes, doing its thing.

And if you’re a business owner wondering who to trust with your payments, well, now you know.