Most people don’t go broke overnight. There’s no dramatic music, no villain twirling a mustache while stealing your wallet. Instead, it’s the quiet, sneaky kind of financial doom, the kind that creeps in while you’re busy living your best life, buying overpriced matchas, and ignoring your insurance policy like it’s a gym membership.

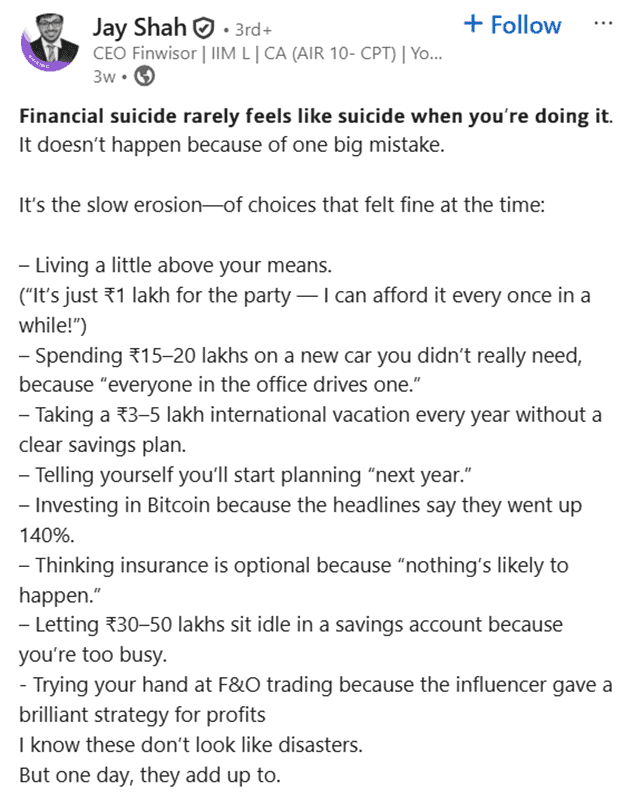

Jay Shah, CEO of Finwisor and low-key financial therapist for the masses, recently dropped a truth bomb on LinkedIn that had people clutching their credit card statements like their pearls. He called it “slow financial suicide”, a term that sounds dramatic until you realize your bank balance is ghosting you like your sitautionship. 🫣

Who Is Jay Shah and Why Should You Care?

Jay Shah isn’t your typical finance bro. He’s an MBA from IIM Lucknow, a Chartered Accountant (AIR 10), and the founder of Finwisor, a financial advisory firm that’s more “let’s fix your money trauma” than “buy this mutual fund or perish.”

His journey began in 2011 when he was handed the reins to the family’s finances. What began as a side hustle evolved into a full-blown mission to help people avoid making money mistakes that may seem harmless but have a lasting impact, akin to a breakup playlist.

Jay’s LinkedIn post didn’t just go viral, it went “I need to cancel my vacation” viral. Because it wasn’t about stock tips or crypto hype. It was about the everyday stuff we do that quietly wrecks our financial future.

The 6 Classic Ways People Financially Self-Destruct

Shah’s post outlined common habits that are financial red flags dressed up as “treat yourself” moments:

- “It’s just ₹1 lakh for the party — I can afford it every once in a while!”

- Spending ₹15–20 lakhs on a new car you didn’t need, because “everyone in the office drives one.

- Taking a ₹3–5 lakh international vacation every year without a clear savings plan.

- Telling yourself you’ll start planning “next year.”

- Investing in Bitcoin because the headlines say they went up 140%.

- Thinking insurance is optional because “nothing’s likely to happen.”

- Letting ₹30–50 lakhs sit idle in a savings account because you’re too busy.

- Trying your hand at F&O trading because the influencer gave a brilliant strategy for profits

Hitting close to home? Because his examples are painfully accurate.

Each of these feels harmless in the moment. But together? They’re like death by a thousand swipes.

The Psychology Behind the Chaos

Jay’s not just talking numbers, he’s talking mindset. He says the real problem isn’t ignorance. It’s discipline.

“Understanding money isn’t hard,” he writes. “But sticking to a plan takes real effort.”

Translation: You know you shouldn’t buy that third pair of sneakers. But you do it anyway because dopamine is a bully.

He even dropped four questions that should be on every adult’s fridge:

- Has your investment ratio increased over the years?

- Could you survive financially if you couldn’t work for six months?

- Do you know why you hold each investment, and when you’d sell it?

- If something happened to you, would your family know what to do?

If you answered “uhhh” to any of these, congrats, you’re normal. But also, maybe start adulting?

Why This Hits Millennials and Gen Z Harder

Let’s be real. We’re the generation that grew up with YOLO, FOMO, and “I’ll G pay you.” We’re also the generation drowning in student loans, side hustles, and avocado toast with a frappe on the side.

Jay’s message hits differently because it’s not about being rich, it’s about being safe. Financial safety isn’t like scrolling on Instagram, but it’s the difference between thriving and surviving.

And in a world where influencers are selling “manifestation journals” for ₹2,000, someone had to say it.

Finwisor’s Chill-but-Smart Approach

Finwisor isn’t your typical financial firm. It’s more like a money dojo. They help clients:

– Plan across investments, insurance, loans, and taxes

– Execute those plans without needing a PhD in finance

– Track and rebalance portfolios like a boss

Jay’s team doesn’t just throw jargon at you. They explain stuff like you’re five, but in a respectful way.

Their vibe? “Don’t panic. We got you.”

What People Are Saying?

Jay’s post lit up LinkedIn like Diwali. One user commented, “Don’t forget spending your life savings on a one-day wedding!” Another said, “This made me cancel my Maldives trip and buy term insurance instead.”

Even finance pros were like, “Okay, this is the realest thing I’ve read all year.”

How to Avoid Slow Financial Suicide (Without Crying)

Here’s a cheat sheet for surviving adulthood without going broke:

– Track your spending: If you don’t know where your money’s going, it’s probably going to Starbucks.

– Automate savings: Set it and forget it. Your future self will thank you.

– Invest smart: Don’t chase trends. Chase goals.

– Get insured: Life happens. Be ready.

– Set goals: “Be rich” isn’t a goal. “Save ₹10 lakh in 2 years” is.

– Say no: To impulse buys, peer pressure, and overpriced brunches.

Final Thoughts: Jay Shah’s Legacy Is More Than Just Advice

Jay Shah didn’t invent budgeting. But he made it cool again. His message isn’t about guilt; it’s about awareness.

He’s helping people realize that financial freedom isn’t about earning crores. It’s about making smart choices consistently.

And if that means skipping one vacation to build a safety net? That’s not boring. That’s baller.

So next time you’re about to swipe your card for something dumb, ask yourself: Is this worth slow financial suicide?

Because Jay Shah already did the math, and the answer is probably no.