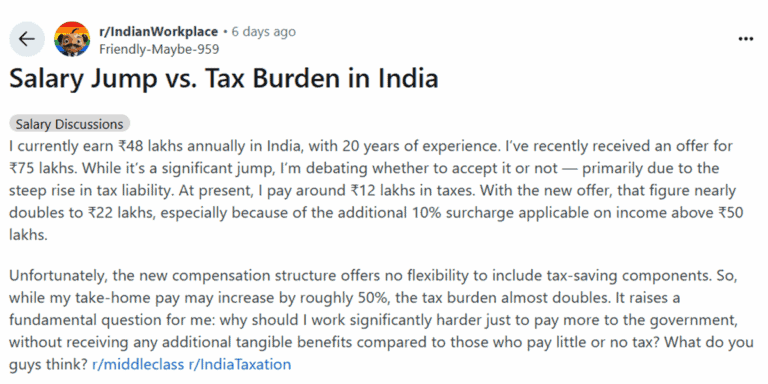

In a turn of workplace fortune (and arithmetic), a seasoned professional with two decades of experience recently set Reddit abuzz after sharing his “financial and moral dilemma” over a tempting job offer: a leap from his current Rs 48 lakh per annum (LPA) salary to a whopping Rs 75 LPA.

Only catch? The taxman’s slice would nearly double, from Rs 12 lakh to Rs 22 lakh, powered by India’s daunting 10% surcharge on incomes above Rs 50 lakh.

The post, aptly titled “Salary Jump vs. Tax Burden in India”, lays out the situation.

The user lamented that while his gross pay would surge by 56%, the celebration dimmed upon seeing the take-home increase by just 50%, thanks to the additional tax. To compound matters (pun intended), the new compensation left no wriggle room for allowances or exemptions, which before had cushioned his tax load.

Naturally, the Reddit world didn’t hold back. Practical users advised a consultant contract for greater tax efficiency—because why pay like an employee when you can bill like a boss?

Others framed the dilemma as a first-world problem, gently joking:

“So, you’ll take home 50% more, but don’t want it because taxes are higher? Give me your problems.”

Another commenter summed up the hard arithmetic:

“It’s a one-time cliff…Your hikes start compounding from a much higher base. You walk away richer, and not just in bragging rights.”

And so, the classic tussle continues: more money, more taxes, more… headaches? Perhaps. But as the Reddit crowd pointed out, passing up extra lakhs just to dodge extra tax could leave you not only lighter in the wallet, but with a lifetime supply of second guesses.