Once known as SmartCoin, today’s Olyv is no longer just an app for quick loans; it’s a full-fledged financial wellness platform revolutionizing how India’s underserved masses engage with money. With over 4 crore users, a footprint across 19,000+ pin codes, and a growing suite of fintech solutions, Olyv is boldly shaping the future of financial inclusion.

But it didn’t happen overnight. Olyv’s growth story is rooted in grit, data wizardry, and a mission to empower the country’s most ambitious, yet underbanked, citizens.

When Big Brains Meet a Big Problem

The Olyv story kicks off in 2017, when four engineering heavyweights from India’s top IITs, Rohit Garg, Amit Chandel, Vinay Singh, and Jayant Upadhyay, got together and asked a simple but powerful question:

Why do so many hardworking Indians still struggle to access credit?

Between them, they had experience building platforms used by millions of users globally, engineering real-time systems, and leading data science projects. They saw a financial system still deeply tied to paperwork, outdated credit scores, and slow processes. They knew tech could do better. And they were ready to build.

Armed with their laptops, some caffeine, and a ton of conviction, the foursome launched SmartCoin, a mobile-based lending app targeting India’s underserved, self-employed, and salaried citizens who couldn’t get loans through traditional means.

The Credit Gap: A Real Problem with a Tech Solution

In India, vast swaths of the population operate outside the scope of formal banking. No credit history? No proof of income? No luck getting a loan. But that’s where tech-powered underwriting changed the game.

Olyv’s early digital lending product used alternative data like mobile usage, transactional behavior, and digital activity to evaluate borrower credibility. Their thesis? People with no credit footprint didn’t equate to credit risk; they were just invisible to the old systems.

And with that, a movement was born: credit access for the uncredited.

From Lending App to Financial Ecosystem: A Major Glow-Up

By 2022, SmartCoin wasn’t just approving microloans anymore. They were giving people better tools to save, plan, build credit, and make financially smart choices.

So in 2023, they took on a new identity: Olyv, a name that hinted at trust, growth, and resilience.

But don’t let the elegant new branding fool you; they were scaling faster than ever.

- Over 6 million loans disbursed

- Nearly 75% repeat customers, showing high trust

- Products now include digital gold savings and credit score management

- Their 2.5 million+ MAUs were loving the broader suite of financial tools

What started as a loan app quickly became India’s go-to financial companion for the next billion users.

What Makes Olyv Tick?

While their mission stayed steady, to empower the underserved through financial inclusion, their tools only got sharper.

Some of their standout offerings include:

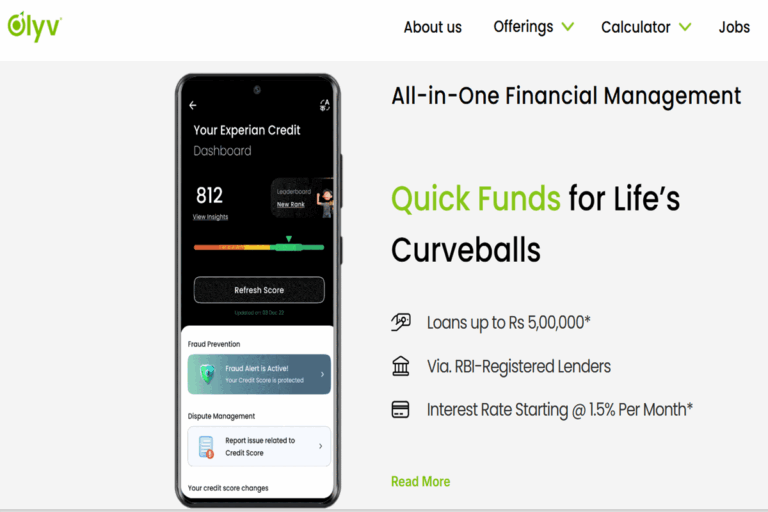

Instant Loans up to ₹5 lakh: Quick approvals based on intelligent credit models, served with speed.

Digital Gold Savings: Letting users invest bite-sized amounts in gold securely and seamlessly.

Credit Score Monitoring Tools: Building a healthy financial footprint requires awareness and tracking.

Simple UX and Tier 2–friendly Language Support: Designed for real users in real towns, not just urban tech bros.

And while their product menu expanded, their speed and simplicity remained core. Apply. Get verified. Receive funds. All in minutes, not days.

Meet the Founders: Olyv’s Financial Fantastic Four

This isn’t your typical boardroom story. Olyv’s four co-founders brought together elite technical chops with a deep understanding of real-world challenges.

Rohit Garg (CEO): IIT Kanpur + IIM Ahmedabad. Believes tech can fix real problems. Especially financial ones.

Amit Chandel (CTO): IIT Bombay + University of Toronto. Previously managed systems processing 100M+ transactions daily.

Vinay Singh (CPO): Dual IIT-B degrees and 8 years at Kiwi Inc. Made sure Olyv’s product didn’t just work, it wowed.

Jayant Upadhyay (COO): IIT Delhi. Built tech for a million+ MAUs. Translated that scale mindset into Olyv’s operational engine.

Together, they built a company where high IQ met high EQ, understanding tech and users alike.

Let’s Talk Finances: The Bottom Line Is Beautiful

Olyv’s growth hasn’t just been anecdotal; it’s backed by serious financial muscle:

– In FY24, their operating revenue crossed ₹250 Cr, with massive growth in new product contributions.

– Despite market pressures, they kept losses low, showing a strong path to profitability.

– They successfully raised Series B funding from names like Trifecta Capital and India SME Investments.

– With consistent traction, investor confidence remains sky high.

Their financial discipline is as sharp as their product sense, a rare combo in the land of flashy, burn-happy fintechs.

Glittering Awards, Global Recognition

Everyone loves a little external validation, and Olyv has plenty:

- Fintech Startup of the Year – 2025 by ET BrandEquity

- Best AI for Tech for Good – Financial Express Futech Awards

- Featured at the World Economic Forum

- Selected for the Google Launchpad Accelerator

- Chosen in the Global Inclusive50 by MetLife, VISA, and IFC

They’re not just building a brand, they’re setting the gold standard for tech-enabled financial inclusion.

Looking Ahead: What’s Next for Olyv?

The next two years are crucial, and Olyv’s not playing it safe.

Here’s what’s on their to-do list:

– Expand product lines, Insurance, investments, and beyond

– Deepen personalization using AI & behavioral data

– Boost digital marketing to reach newer audiences

– Form new partnerships with financial institutions and tech platforms

– Double down on Tier 2 & Tier 3 outreach

Because while the app may live on a screen, Olyv knows that trust lives in people’s lives, and they’re ready to show up, everywhere.

Final Thoughts: Finance for the People, Built by the People

Olyv’s story is a masterclass in how to build for Bharat, not just for Bandra.

By staying obsessed with solving real problems, fast credit, easy savings, and financial literacy, they’ve turned a loan app into a life-changing money companion for crores.

And their mission? Still the same: to empower the overlooked and overworked with the tools they need to win financially.

So the next time someone tells you finance is boring or too complicated, show them Olyv.

They might just change their mind and their money game.