From Trichy to Tech Titan: The Rise of Juspay

Imagine a world where online payments are seamless, secure, and frictionless, where you don’t have to fight with multiple OTPS, buggy interfaces, or failed transactions. That’s the vision Vimal Kumar, a tech genius from Trichy, Tamil Nadu, had when he founded Juspay in 2012.

Back then, India’s digital payment scene was a hot mess. Online transactions were slow, unreliable, and confusing for first-time users. But Vimal saw an opportunity to make payments smooth, reliable, and accessible for millions. Fast forward to today, Juspay powers 200 million daily transactions globally, manages a GMV exceeding $670 billion annually, and is trusted by Amazon, Google, Visa, Mastercard, and more. Not too shabby for a startup that began with a single laptop and a dream. 😎✨

The Man Behind Juspay: Vimal Kumar’s Journey

If you want to talk about tech brains, grit, and vision, Vimal Kumar ticks all the boxes.

- Born and raised in Trichy, he grew up fascinated by the mechanics of technology.

- Started his career at AWS, where he built scalable, high-performance systems.

- Joined BankBazaar as CIO, learning the ins and outs of fintech.

- Had an epiphany, why not build something that could fix India’s digital payment system?

Initially, Vimal considered starting an education platform to train young tech talent. But let’s be honest, changing how billions transact online? That’s a way bigger flex.

The Juspay Vision: Making Payments Smoother Than Butter

Juspay wasn’t built just to process payments, it was designed to reshape the entire experience. At a time when digital payments in India were complicated and unreliable, Juspay came in like a tech superhero, solving problems that nobody else wanted to touch. Here’s how they made magic happen:

- One-Click Payments – Because no one likes clicking five buttons just to pay for their coffee

- AI-Powered Fraud Prevention – Blocking scammy transactions before they even happen

- 999% Reliability – Because “payment failed” messages should be extinct

- Optimized Checkout Experience – Fast, smooth, and rage-free

Juspay was basically like Wi-Fi for payments, invisible, seamless, and working flawlessly behind the scenes.

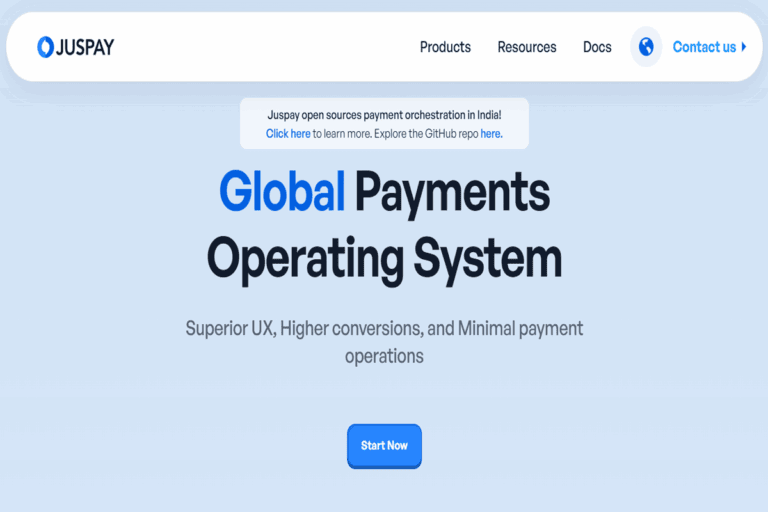

What Makes It So Powerful?

Juspay’s secret sauce is its payment orchestration system, think of it as the brain behind every online transaction. It connects with 300+ payment providers, ensuring that payments never get stuck, always go through, and stay secure AF. Here’s how it works:

- Multi-Region Active-Active Architecture – Keeping transactions safe and running worldwide

- Horizontally Scalable Cache-Based Layer – Ensuring no slowdown, even with massive transactions

- Fraud Prevention & Security Measures – Because cyber scammers don’t stand a chance against Juspay

That’s why big names like Amazon, Microsoft, and Visa trust Juspay; it doesn’t just work, it works perfectly.

Juspay’s Big Moves: Funding and Expansion

When you’re revolutionising digital payments, funding isn’t just nice to have, it’s essential. In 2023, Juspay secured $60 million in Series D funding, led by Kedaara Capital, with participation from SoftBank and Accel. The goal? To scale globally, push AI-driven payment solutions, and make transactions smoother than ever. 💸✨

From its innovation hubs in Bangalore, Dublin, São Paulo, San Francisco, and Singapore, Juspay is now going global. The plan? Becoming the operating system for payments worldwide.

Juspay’s Role in Building India’s Digital Economy

Juspay wasn’t just built for companies, it was built for India. Vimal Kumar and his team didn’t just want to make payments easier; they wanted to accelerate India’s financial inclusion. Some of their biggest contributions?

- Played a key role in building BHIM UPI, making digital payments accessible to everyone

- Powers transactions for Flipkart, Amazon, Uber, keeping e-commerce alive

- Optimized digital payments for banking institutions, streamlining fintech adoption

With cashless transactions becoming the norm, Juspay is literally shaping how India pays.

The Challenges Juspay Overcame

Every game-changing startup hits roadblocks, and Juspay was no exception.

- First-Time Users Were Confused – Many Indian consumers had never used digital payments before. Juspay made it easy with frictionless checkout.

- Security Concerns – Online fraud was a major risk. Juspay beefed up security with AI-driven fraud prevention.

- Tech Scalability Issues – Handling millions of daily transactions wasn’t easy. Juspay optimised its system for ultra-fast processing.

By tackling these challenges, Juspay built trust with businesses, banks, and consumers alike. 💪

What’s Next for Juspay?

With $60 million in fresh funding, Juspay is full throttle towards the future. Here’s what’s coming:

- Advancing AI-Driven Payments – Smarter fraud detection and faster checkouts

- Expanding Global Presence – Juspay wants to be everywhere

- Strengthening Banking Integrations – Making payments even smoother for financial institutions

- Shaping the Future of Fintech – Vimal Kumar’s vision is to make Juspay the payment backbone of the world

One thing’s certain: the future of digital payments looks like Juspay.

Final Thoughts: The Payment Revolution That Changed India

What started as a small dream in 2012 turned into a $670 billion payment powerhouse. Juspay isn’t just making transactions easy, it’s revolutionizing how the world pays.

With 200 million daily transactions, 300+ payment providers, and 99.999% uptime, Juspay has become an unstoppable force in fintech. And at the center of it all? Vimal Kumar, the tech visionary who changed India’s digital payments forever.

So next time you make a quick one-click purchase online, just remember, you’re riding on Juspay’s innovation. Because great tech should feel effortless. 🚀💰✨